Did you know that businesses are expected to lose nearly $370 billion to payment fraud by 2028? No matter if you operate in ecommerce or fintech, online fraud creates a destructive cycle for both businesses and consumers.

The consequences of digital payment fraud are twofold. Beyond immediate financial losses, companies are forced to pass operational recovery costs on to customers, all while implementing more friction-heavy hurdles to verify legitimacy.

The current digital payment climate has created a high-stakes race for AI technology. While fraudsters leverage generative AI to craft sophisticated attacks, cybersecurity innovators are countering with advanced detection models that are currently staying well ahead of the curve.

The Modern Digital Payment Threat Landscape

With nearly 20% of all shopping happening online today, ecommerce fraud is a widespread problem. Furthermore, movements like Open Banking have decoupled payment gateways from traditional banking infrastructure. Payment rails are integrated into non-traditional ecosystems, often operating in gray areas where traditional regulatory frameworks are still catching up.

Consider these relevant statistics:

- 2.77 billion people shopped online in 2025

- Every $1 stolen by fraudsters costs online retailers $3.75

- 20% of all ecommerce revenue is lost to fraud in Latin America

These numbers have come about due to a confluence of factors. The pandemic permanently accelerated digital adoption and greatly expanded the global attack surface. At the same time, fraudsters have grown more brazen and sophisticated in their methods.

Problem #1: Speed

When it comes to fraud, speed is one of the biggest challenges for modern digital payment systems. Consumers now demand instantaneous transactions and frictionless convenience. According to a survey by The Federal Reserve, “around 6 in 10 consumers state it’s important for their financial institution to offer instant payments.” While digital service providers strive to meet these stringent demands, some fall short on architecting secure solutions.

Modern payment rails like ACH and instant payments require detection in milliseconds, not minutes. When payment systems don’t meet these requirements, fraudsters can exploit the latency gap to execute rapid-fire transactions before defenses can react. When the security layer can’t resolve within the transaction window, the money vanishes before an alert even triggers.

Problem #2: Sophistication

While AI technology is revolutionizing user experiences and cybersecurity, it is simultaneously being weaponized by bad actors. Fraudsters are leveraging Gen AI to craft deepfakes and automate attacks that bypass even the most secure payment gateways. In fact, studies show that AI was behind 20% of all online fraud committed in 2024.

While phishing emails have traditionally been easy to spot due to misspellings and other obvious mistakes, Gen AI is changing the game with flawless emails that are much harder to detect. In another example, deepfake technology conducts business email compromise (BEC) scams where an AI-generated bot poses as a high-powered executive to authorize urgent wire transfers.

Problem #3: Industrialization

Criminals are also using AI to industrialize and scale their attacks. AI now allows a single actor to conduct campaigns that previously required an entire team of hackers. Within this realm, fraud-as-a-service (FaaS) also greatly lowers the barrier to entry for cybercriminals by helping amateurs execute sophisticated scams. Nearly 60% of companies today have been targeted by FaaS attacks.

By automating the creation of hyper-personalized lures and convincing synthetic identities, FaaS platforms allow attackers to bypass standard payment verification protocols in large-scale attacks. With industrialized transaction fraud, bad actors use AI to mimic legitimate purchasing patterns and instantly adapt their tactics when a payment is declined.

The Power of AI-Powered Fraud Detection

In the high-stakes race for AI technology, modern fraud defense has evolved from rigid, reactive filters into intelligent, self-learning ecosystems that anticipate threats and contextualize every digital interaction.

Solution #1: Behavioral Biometrics

Behavioral biometrics are a giant leap beyond traditional login credentials and MFA. With a much more granular and dynamic approach, they analyze how a user interacts with their device by monitoring:

- Keystroke dynamics

- Mouse jitter

- Touchscreen pressure

Once baseline data is established, AI can identify subtle deviations that suggest an unauthorized user or an automated bot is attempting to bypass security. Behavioral biometrics are effective against Authorized Push Payment (APP) scams, “when fraudsters deceive consumers … to send them a payment under false pretences to a bank account controlled by the fraudster.” AI picks up on subtle deviations that indicate the user is acting out of character.

Solution #2: Graph Analytics

While traditional payment systems examine transactions in isolation, graph analytics map the complex web of relationships between accounts, devices, and IP addresses. By visualizing these connections as nodes and edges, AI can identify patterns like a single device linked to dozens of seemingly unrelated bank accounts.

Graph analytics is one of the strongest weapons against sophisticated fraudsters, especially with synthetic identity unmasking. Unlike human reviewers who see isolated applications, graph analytics uncover identity clusters where fraudsters have stitched together real stolen data with fabricated details. By analyzing the proximity of data points, AI reveals that hundreds of unique customers actually share a single hijacked social security fragment or physical address.

Solution #3: Machine Learning

Because they can analyze vast datasets in real-time, machine learning (ML) models often serve as the brains of modern fraud detection platforms. Amazingly, ML technology can analyze data millions of times faster than human beings. Moreover, ML models adapt to ever-changing fraud tactics by continuously training on new transaction data.

High-speed payment authorization is a strong use case for ML technology. With instant peer-to-peer transfers or high-value cross-border transactions, AI models must evaluate risks in milliseconds to avoid latency issues that hinder UX. In such cases, ML algorithms instantly ingest hundreds of data points – like velocity, transaction amount, and geolocational consistency – to approve legitimate payments and flag high-risk transactions.

Dev.Pro: Architecting the Future of Resilient Payments

Fighting payment fraud in today’s high-stakes climate requires more than standard engineering. It demands specialized technical talent capable of building self-learning AI systems that operate at millisecond speeds.

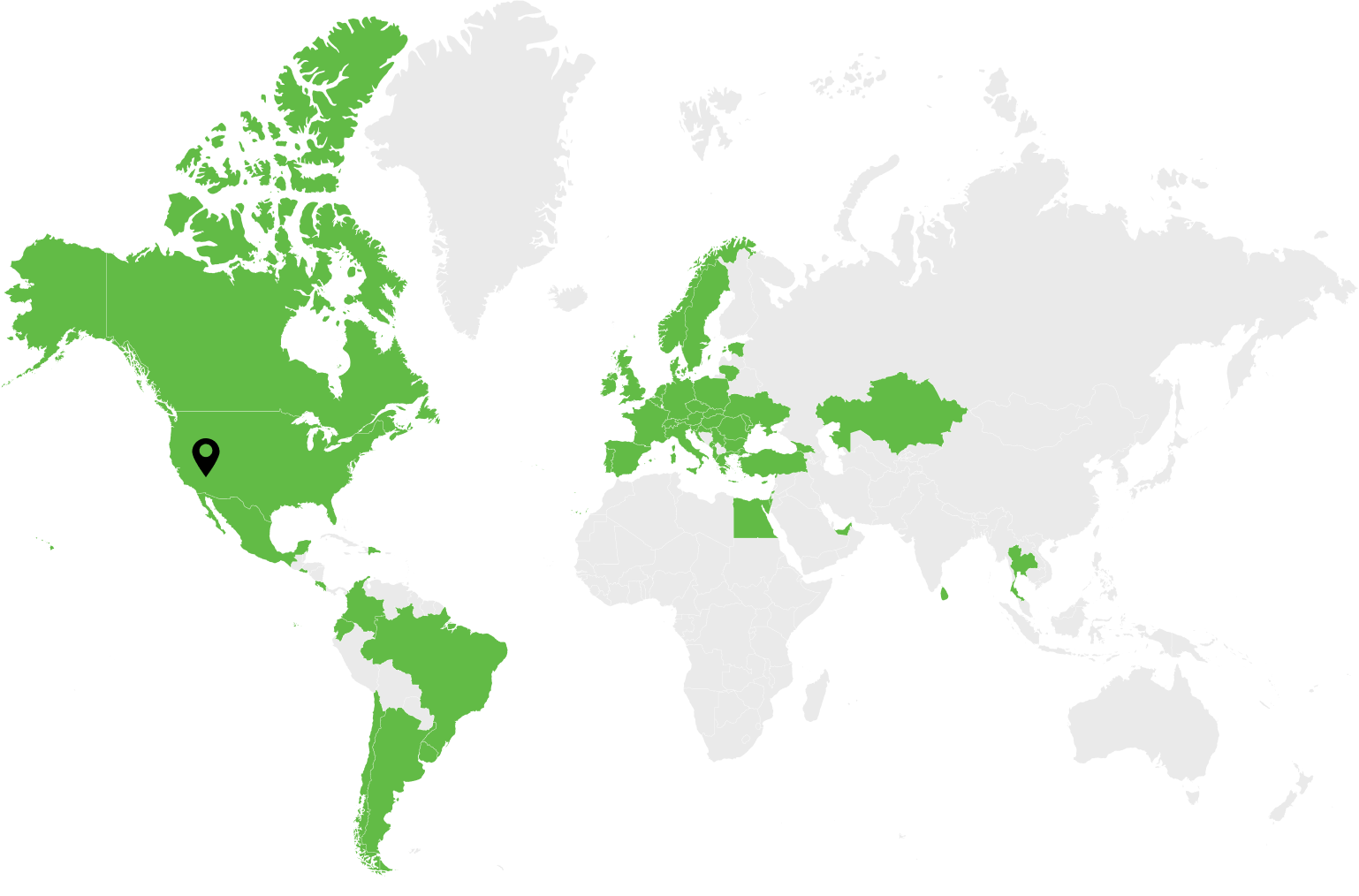

Dev.Pro provides the domain expertise and technical knowledge needed to architect complex, AI-native defenses for today’s most cutting-edge payment solutions. Whether you require outsourcing and outstaffing services, we deliver the talent necessary to help stop fraudsters in their tracks.

Schedule a consultation today!