Governments have embraced the benefits of blockchain technology and have taken steps to provide a legal framework for all parties to feel safe in this new decentralized reality. Conventional financial institutions have started seeing opportunities in collaboration with FinTech startups, – more than a threat. Companies developing financial software solutions for InsurTech, PayTech, trading, and real estate are eager to merge with big names in the traditional finance industry to scale up faster armed with an in-depth regulatory acumen, or simply cash out.

After a short Covid-related setback in FinTech funding, investments in 2021 increased significantly, almost reaching 2019’s all-time high of $213.8 billion. Last year, $210.1 billion was invested in the sector, up 68% compared to 2020.

The number of FinTech unicorns is another sign of the industry’s revival. According to CB Insights, 40 out of the 47 total unicorns in the blockchain have come to rise in 2021, with two of them getting as far as going public.

This white paper provides an up-to-date overview of Fintech trends and an overview of the future, including:

- Segment’s market overview with startup funding distribution.

- Use cases and new applications of technologies in the FinTech economy sector: AI, ML, big data, IoT, QR codes, and voice recognition technologies.

- Trends shaping the way we pay, buy, lend, compare prices, trade, send money transfers: BNPL, cashless payments, digital wallets, mobile payments, challenger banks, BaaP, and wearable tech as payment devices.

Is this Fintech report a 9-minutes well-spent for you?

You will find these insider insights helpful, if you are:

- Affiliated with traditional financial institutions, like licensed banks and trading establishments and need to learn more about the toponymy of FinTech.

- A software development company working on developing a financial management system or a tool for adjoining industries, like insurance, trading, or real estate.

- A third-party software vendor with a tech solution for the banking or accounting industries looking for practicable methods to enhance your product and distribution network.

- Working on creating a regulatory or legal framework for the upcoming technologies in decentralized finance, and are looking to better understand the fintech ecosystem in the US and EU.

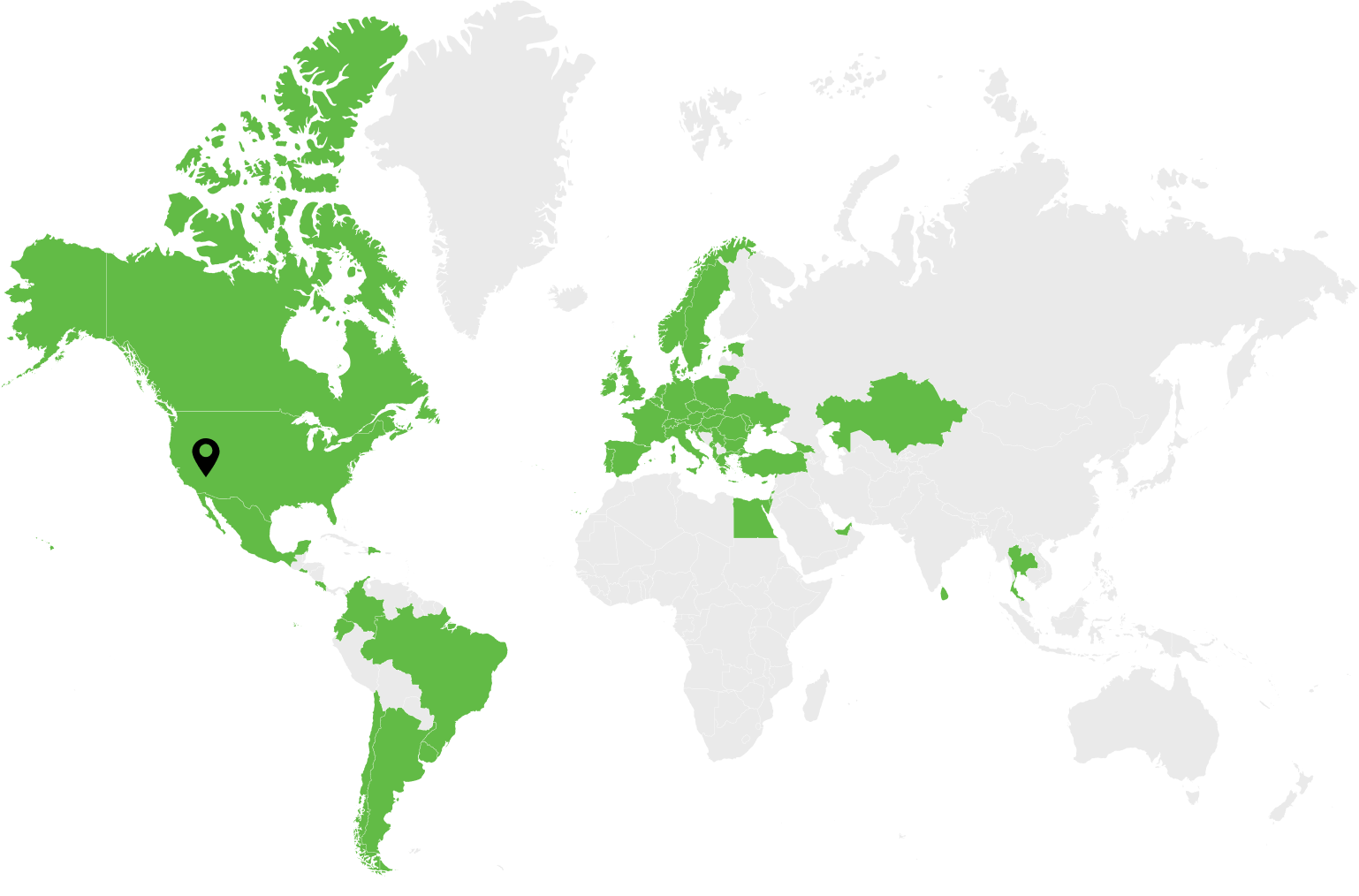

The talented software engineers in Dev.Pro have been working to advance the FinTech revolution, as our apt software team extensions contribute to strengthening conventional finance companies as well as DeFi startups. With 5 ongoing blockchain-enabled projects and over 120 team members engaged with them, we have extensive field-proven expertise to share [with clients like Inveniam, Securrency, and XCM].

Another major FinTech partner is a Fortune 500 company, which develops custom software products for SMBs in a range of business functions affiliated with payments, billing, and accounting.