The fintech industry is growing at a remarkable pace. Studies from McKinsey & Company show that revenue from fintech is expected to increase from $150 billion in 2022 to over $400 billion by 2028 — representing a 15% annual growth rate.

While innovative apps like Plaid and Robinhood have transformed how people interact with money, experts argue the real value of fintech lies in the vast amount of data it generates. While advancements like cloud scalability help manage operational demands, the industry is still falling short of its transformative potential.

The missing link lies in the ability to transform raw data into actionable financial intelligence. This is precisely where AI comes into play. AI captures and analyzes vast amounts of data far beyond human comprehension — making it the ideal tool for advancing fintech.

Embracing the Power of Data in Fintech

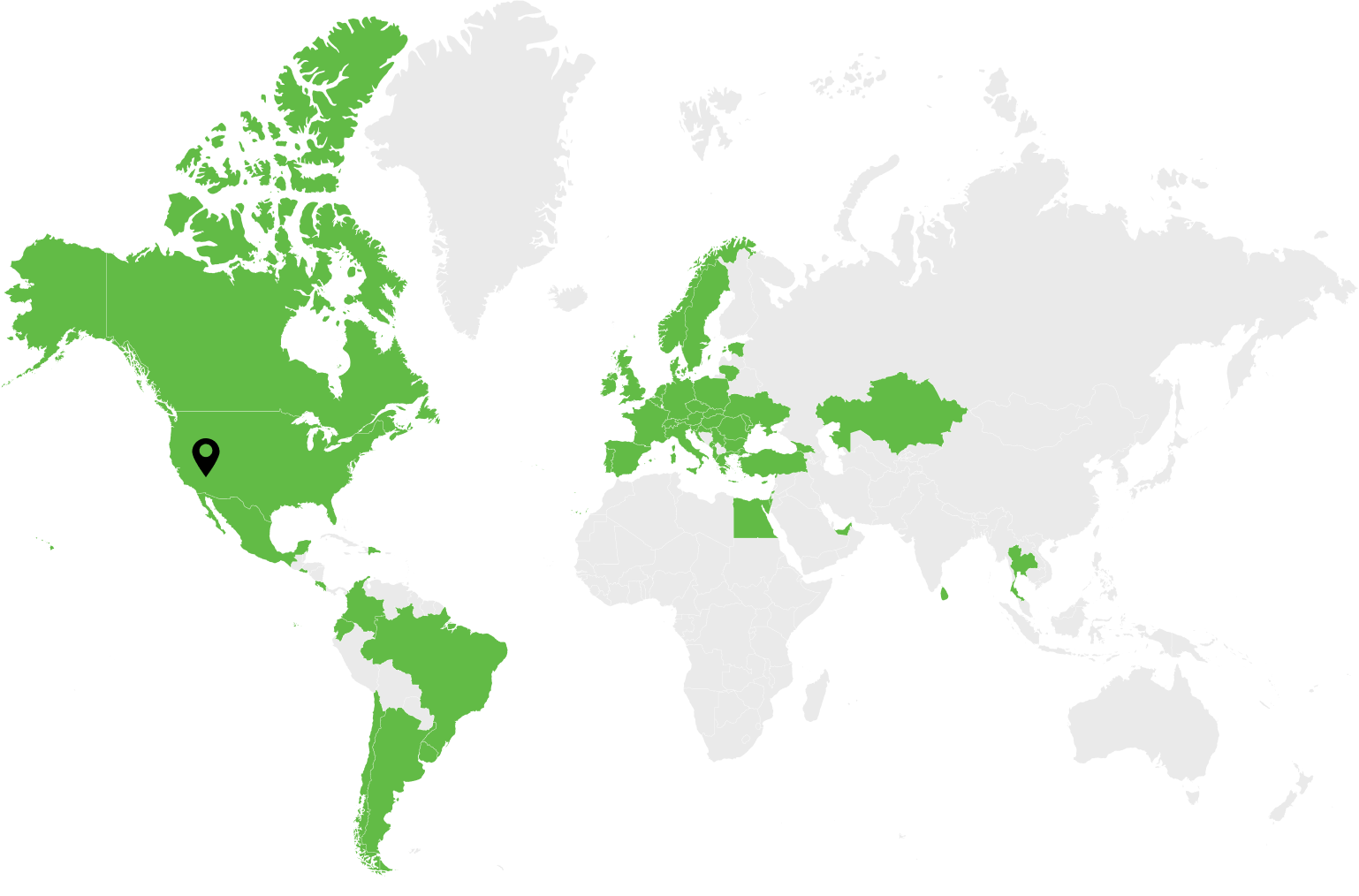

As the financial industry has become increasingly digital, the volume of data generated by transactions has expanded exponentially. According to Statistica, “In 2023…645.8 billion non-cash transactions were carried out in Asia-Pacific. Europe and North America followed, with 361.1 and 237.3 billion transactions respectively.”

As global transactions soar into the hundreds of billions, fintech firms are uniquely positioned to turn this growing data stream into real-time intelligence with AI integrations.

Fraud Detection & Risk Management

With advanced data analysis, AI quickly detects anomalies and recognizes trends to mitigate risk and prevent fraud.

Credit Assessments

Credit risk management is an important use case for AI in modern fintech. By reviewing patterns in past financial behavior, AI helps predict which borrowers may be more likely to default on loans.

On the business side, increased automation helps financial institutions make faster, smarter lending decisions. At the same time, customers enjoy a more streamlined credit approval process at important times like when buying a home or car.

Predictive Fraud Scoring

Fraudsters often exploit financial systems to access sensitive data, but AI counters attacks with deep learning models that monitor user behavior and detect anomalies. By evaluating patterns with transaction location, time, and frequency, AI can assign predictive fraud scores and flag unusual activity before it becomes a serious threat.

Enhanced Identity Verification

With an increasing threat landscape and growing distrust for passwords, new identity verification methods like biometrics are increasingly important. In fact, 80% of data breaches are the result of compromised passwords.

AI powers biometric authentication in fintech by analyzing facial features, fingerprint patterns, and voice characteristics in real time — offering a more convenient and secure means for identity verification than passwords.

Personalized Banking Experiences

One of the most powerful applications of AI in fintech is the ability to turn raw banking data into predictive insights to power personalized experiences.

Tailored Investment Advice

AI-powered digital wealth advisors analyze market trends, risk tolerance, and user financial goals to provide personalized investment strategies. To illustrate, the automated financial advisor platform PortfolioPilot gained $20 billion in assets during its first 2 years in operation. Payments Journal reports, “The AI platform offers more personalized service than many human wealth managers.”

Personalized Marketing Content

Since AI uses pattern recognition and classification to group data based on shared attributes, it is a valuable tool for creating personalized marketing content. By looking for patterns in user data, AI helps banks and other fintech providers tailor experiences to individual users to increase conversions and enhance customer satisfaction.

Enhanced Customer Support

With the ability to understand the fine nuances of human language, AI-driven personal assistants provide top-notch customer support across digital channels.

Contextual Awareness for Seamless Interactions

Natural Language Processing (NLP) strengthens AI’s role in fintech by providing a deeper understanding of user conversations, from emotional cues to financial vocabulary. Rather than relying on isolated keywords, NLP understands the broader context of a conversation by incorporating historical financial activity and user behavior to improve service accuracy.

Responses to Customer Queries

Fueled by NLP, AI-driven personal assistants provide users with extremely accurate answers to queries. For example, a chatbot can recognize if a user is requesting a balance inquiry, reporting fraud, or seeking investment advice. They can even refer back to past conversations.

Many businesses are making the shift to AI-powered customer support. Gartner predicts that 25% of organizations will use chatbots as their primary customer service channel by 2027.

Summary

Fintech has revolutionized financial services in a short time by reshaping how people and businesses manage everyday transactions. However, we’ve only scratched the surface of fintech’s potential. As billions of digital transactions take place daily, the real opportunity lies in the effective application of financial data.

AI’s ability to rapidly capture and analyze massive datasets with unmatched speed and accuracy makes it a game-changer for fintech. Whether you’re a consumer or a business, AI-enhanced technology promises to make your transactions more secure, while also making your experience more enjoyable.

Stay Ahead on AI in Fintech with Dev.Pro!

Ready to bring smarter, faster, and safer AI-powered experiences to your fintech platform? Partner with Dev.Pro to integrate advanced AI solutions that elevate your digital commerce strategy. Get started today!