Did you know that 90% of banks in the United States, Canada, and the EU are exploring blockchain technology? Blockchain’s decentralized framework provides new levels of data integrity by shifting control toward users and reducing risks for businesses reliant on centralized models.

In the most basic sense, blockchain is a shared digital ledger that records transactions and data entries in real time. Rather than being shared on a single, on-premise server, the ledger is distributed across a global network of computers, known as nodes.

While originally developed for cryptocurrency, blockchain has opened a floodgate of new use cases in the business world. In this article, Dev.Pro explores the benefits of blockchain technology and how it applies to fintech, healthtech, and insurtech.

Why is Blockchain a Powerful Tool?

As IBM explains, “Blockchain is sometimes called a ‘trustless’ network, not because business partners don’t trust each other, but because they don’t have to.” With this technology, each new record, or block, is linked to the previous one to form a chain. Since each block references the one before it, and everyone on the network has a copy, it’s nearly impossible to alter past data without being noticed.

A few key ways businesses benefit from blockchain include:

- Increase transparency with partners, customers, and vendors

- Reduce fraud that comes with perimeter-based networks

- Automate tedious administrative work

- Improve traceability for products & supply chains

- Streamline payments and financial settlements

Different industries take advantage of blockchain technology for their own distinct use cases.

Key Industries That Benefit from Blockchain

Important industries like fintech, healthtech, and insurtech are taking advantage of blockchain’s decentralized network to reduce risk, improve efficiency, and strengthen user experiences.

Fintech

Since blockchain is managed independently of centralized banks, studies report “FinTech and blockchain are increasingly viewed as gateways to financial inclusion, economic growth, and resilience in the face of global market volatility.” Within this realm:

- Distributed ledgers in fintech enhance the security, transparency, and accessibility of payments for developed and undeveloped nations around the world.

- Blockchain streamlines payments, strengthens Know Your Customer (KYC) verification, and facilitates asset tokenization to improve efficiency and strengthen user trust.

Fintech Use Case: Smart Contracts

In fintech, smart contracts automate complex agreements by executing predefined terms directly on the blockchain. Since these self-enforcing digital contracts eliminate the need for intermediaries like bankers, they provide faster, more reliable transactions. For example, in lending and credit platforms, an agreement can automatically release funds to a borrower once collateral is verified, without the need for manual approval.

Healthtech

Blockchain is emerging as a foundation for secure data exchange with healthtech organizations. Applications of the novel technology are far-reaching, including improved patient privacy, enhanced interoperability, and better adherence to compliance and data protection standards.

- Blockchain eliminates the data silos that limit information sharing across patient record systems. By enabling secure, interoperable data exchange, providers can uncover insights that drive more affordable treatments and advanced therapies for patients.

- In an industry plagued by data breaches and complex privacy requirements, blockchain helps maintain HIPAA compliance while giving patients greater control over their personal information.

Healthtech Use Case: Pharmaceutical Product Tracing

Blockchain creates secure, end-to-end records of every transaction in the pharmaceutical supply chain. Each time a product changes hands from a manufacturer to a distributor and finally to the pharmacy, the event is logged in an immutable audit trail. This transparency protects product authenticity, stops criminal activity, and allows manufacturers to recall items if safety issues arise.

Insurtech

Blockchain is redefining how insurtech companies manage trust, transparency, and efficiency. With its decentralized infrastructure, blockchain reduces administrative overhead, enhances customer confidence, and supports compliance across complex insurance ecosystems.

- Secure data sharing and automated workflows provide faster claims resolution and strengthen regulatory compliance, ultimately improving trust between insurers, brokers, and policyholders.

- Smart contracts in the insurtech industry automatically trigger payments once policy conditions are met, thus reducing operational costs for insurance providers in important verticals like health, auto, and more.

Insurtech Use Case: Identity Verification

Insurers leverage blockchain-based identity verification to streamline policy underwriting. Customer data, like medical histories and driving records, is securely shared with authorized providers on a distributed ledger. In turn, this data is available when needed, while also being protected throughout its lifespan.

What are Potential Roadblocks to Implementing Blockchain Technology?

While blockchain is an immensely promising technology, certain roadblocks still hinder its widespread adoption among small and large organizations alike.

Complexity

Blockchain is a complex technology that requires a high level of technical expertise to implement and maintain. Beyond understanding distributed ledger architecture, teams must also manage elements such as consensus algorithms, smart contract deployment, and cryptographic key management. Additionally, integrating blockchain with legacy systems and existing databases can pose significant architectural and interoperability challenges.

Skills Gap

The specialized skills required to design, implement, and maintain blockchain are in short supply. In fact, studies report that blockchain technology could create up to 1 million new jobs by the year 2030. For reasons such as this, blockchain developers in the United States are in extremely high demand, making over $130,000 per year on average. All signs indicate that the skills gap in blockchain will continue to widen as demand outpaces available talent.

Summary

Since it can transform nearly every facet of digital interactions, blockchain is often viewed as the start of a new digital era. Its decentralized framework provides new levels of data integrity by shifting control toward users and reducing risks for businesses using centralized models. Organizations in key industries like fintech, healthtech, and insurtech stand to benefit from blockchain in a myriad of ways — from increased security to improved customer service.

Yet, as seen with any emerging technology, blockchain is only as strong as the engineers and developers who put it into motion. Due to the complex nature of the technology, the specialized skills required to design, implement, and maintain blockchain are in short supply. As a result, the IT talent pool must catch up with blockchain before its full benefits can be realized.

Advance Your Blockchain Strategy with Dev.Pro!

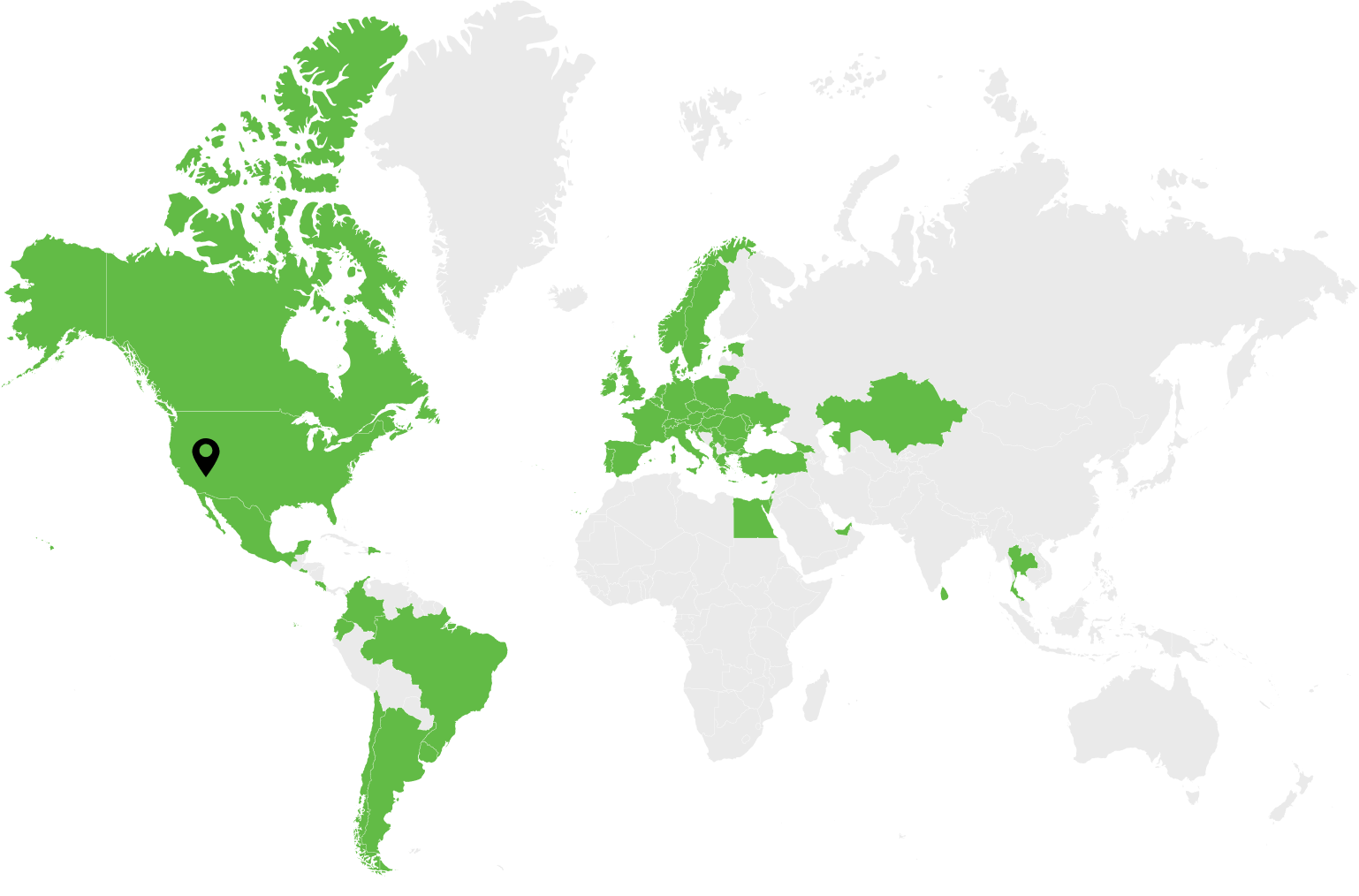

From fintech to healthtech, blockchain development demands precision, compliance, and hands-on experience. With Dev.Pro, you gain access to vetted specialists who understand how to design, implement, and scale secure blockchain solutions.

Partnering with Dev.Pro is one of the most effective ways to overcome the technical challenges and talent shortages that slow blockchain adoption.

Speak with a specialist today!