If anything has come to define user needs in the digital era, it’s finding the right balance between convenience and security. Especially in highly regulated industries like law and financial services, striking this balance can literally make or break a company.

For example, research shows that 70% of customers consider simple, user-friendly digital experiences a key factor when deciding which financial institution to do business with. In enterprise environments, smart contracts enhance UX by reducing friction, while automating verification and execution to deliver secure transactions.

As organizations modernize legacy workflows, smart contracts have emerged as a foundational component of next-generation digital infrastructure for the legal and financial industries.

What are Smart Contracts?

Smart contracts are self-executing programs deployed on a blockchain that automate executions and workflows once predefined conditions are met. Legal and financial services companies enjoy smart contracts because they deliver immediate, deterministic outcomes without intermediaries or manual intervention.

At their core, smart contracts operate on simple “if/when…then…” logic written directly into the code. Once a distributed network of computers verifies predefined conditions, the smart contract automatically executes the agreed actions, such as:

- Releasing funds

- Registering assets

- Issuing notifications

- Advancing the next step in a workflow

For example, in a U.S. commercial property transaction, a real estate law firm records a smart contract on a blockchain that automatically releases escrow funds and registers title transfer once a distributed network verifies that inspection reports, lender approvals, and closing documents are complete.

Smart Contracts and Blockchain Explained

Blockchain is the foundation of smart contracts because it provides a shared, tamper-resistant ledger and a distributed network that can independently verify and enforce digital agreements. Once executed, a smart contract transaction is recorded immutably on the blockchain, so it can never be retroactively altered.

Importantly, smart contracts are not limited to a single condition or outcome. They can encode multiple stipulations, exception handling, and predefined dispute-resolution logic agreed upon by all participants. For example, a bank can deploy a smart contract that releases loan funds when conditions are met, applies alternative terms if conditions are partially met, and triggers remediation workflows if obligations are not fulfilled.

Benefits of Smart Contracts

Smart contracts deliver measurable value by replacing manual, trust-based processes with automated, verifiable execution. For legal and financial organizations, this shift strengthens operational consistency while reducing friction across complex, compliance-driven workflows.

Immutability

As Bloomberg Law explains, “smart contracts deployed on public blockchains are immutable by default, ensuring that the rules governing digital transactions can’t be changed arbitrarily once established.” When users engage with a smart contract, they have confidence it will run consistently and as intended, without being altered after deployment.

For example, in financial services, once a decentralized lending smart contract is deployed on a public blockchain, its interest calculation and liquidation rules cannot be altered by the issuer.

Transparent Execution Logic

Transparent execution logic refers to the ability for authorized participants to inspect, verify, and understand how a smart contract will behave before it is executed. Because the code is deployed on a blockchain (often a public one like Ethereum), its rules, conditions, and outcomes remain visible and verifiable.

A good example would be a real estate law firm using a smart contract for a commercial lease agreement. Since critical factors like rent escalation, renewal, and penalty clauses are published directly on the blockchain, landlords, tenants, and auditors can verify in advance how each obligation will be enforced.

Tamper-Resistant Recordkeeping

As the Blockchain Council reports, traditional record-keeping systems have proven increasingly vulnerable, with nearly 2.6 billion personal records compromised between 2022 and 2023. In fact, data breach incidents rose by 20% in Q1 2023 alone.

Blockchain secures records through cryptographic encryption and digital signatures, providing a level of data protection that traditional record-keeping systems can’t match. Its decentralized architecture limits single points of failure, making large-scale tampering impossible without control of a majority of the network.

Automated Enforcement Without Intermediaries

Smart contracts automate enforcement by embedding agreed obligations directly into code and executing them through a distributed blockchain network. Instead of relying on banks, registries, or courts to verify conditions and enforce compliance, the network validates predefined criteria and executes outcomes automatically.

Blockchain shifts contract enforcement from a post-agreement concern to an upfront design exercise, where conditions, exceptions, and remedies are defined with precision. In a property transaction, a smart contract can record ownership and release funds once inspections and payment requirements are verified, eliminating the need for escrow agents or post-closing intervention.

Smart Contracts in Financial Services

Blockchain shifts contract enforcement upstream in financial services to balance customer convenience with institutional security. While customers experience faster approvals and near-real-time settlement, organizations benefit from consistently enforced controls, such as know your customer (KYC) verification, collateral validation, transaction limits, and compliance checks.

Considering that regulatory penalties imposed on global financial institutions increased by 417% during the first six months of 2025, the benefits of smart contracts are tough to ignore. By embedding security and compliance logic directly into execution flows, smart contracts resolve a long-standing tension between speed and risk management in financial services. With this novel tech, institutions can shorten settlement cycles and reduce manual error while maintaining consistent risk controls across high-volume transactions.

Smart Contracts in the Legal Industry

In the legal industry, smart contracts help balance ease of execution for users with the rigor required to protect contractual intent. Instead of relying on calendar reminders, manual enforcement, and post-breach remediation, legal teams define conditions upfront. This reduces friction for stakeholders while ensuring that enforcement remains precise, predictable, and defensible.

According to Businesswire, “56% of legal teams take a week or more to close standard contracts like NDAs, with some taking 15+ days for routine agreements.” These delays are driven by manual workflows that slow execution and increase the risk of errors, missed obligations, and reputational damage. By contrast, smart contracts automate execution and enforcement, so legal teams can standardize approvals, enforce terms consistently, and reduce contract turnaround time.

Break Through the Barriers to Smart Contract Implementation

According to Fortune Business Insights, the global smart contracts market is projected to grow from $2.14 billion in 2024 to $12.07 billion by 2032. Yet, this growth can only be realized if organizations address key challenges that hinder the adoption of blockchain technology:

- Skill Gaps: Blockchain initiatives require specialized expertise across cryptography, distributed systems, and secure architecture design. For these reasons, blockchain adoption is expected to create up to 1 million new software engineering roles by 2030. Without the right talent behind the scenes, organizations risk poorly designed contracts, security vulnerabilities, and stalled implementations.

- Legacy Systems: Most enterprises operate within complex legacy environments built around centralized databases, ERP platforms, and existing compliance workflows. Integrating blockchain solutions into these systems requires careful architectural planning to ensure data consistency, interoperability, and minimal operational disruption. This notion is only heightened in highly regulated industries like law and financial services.

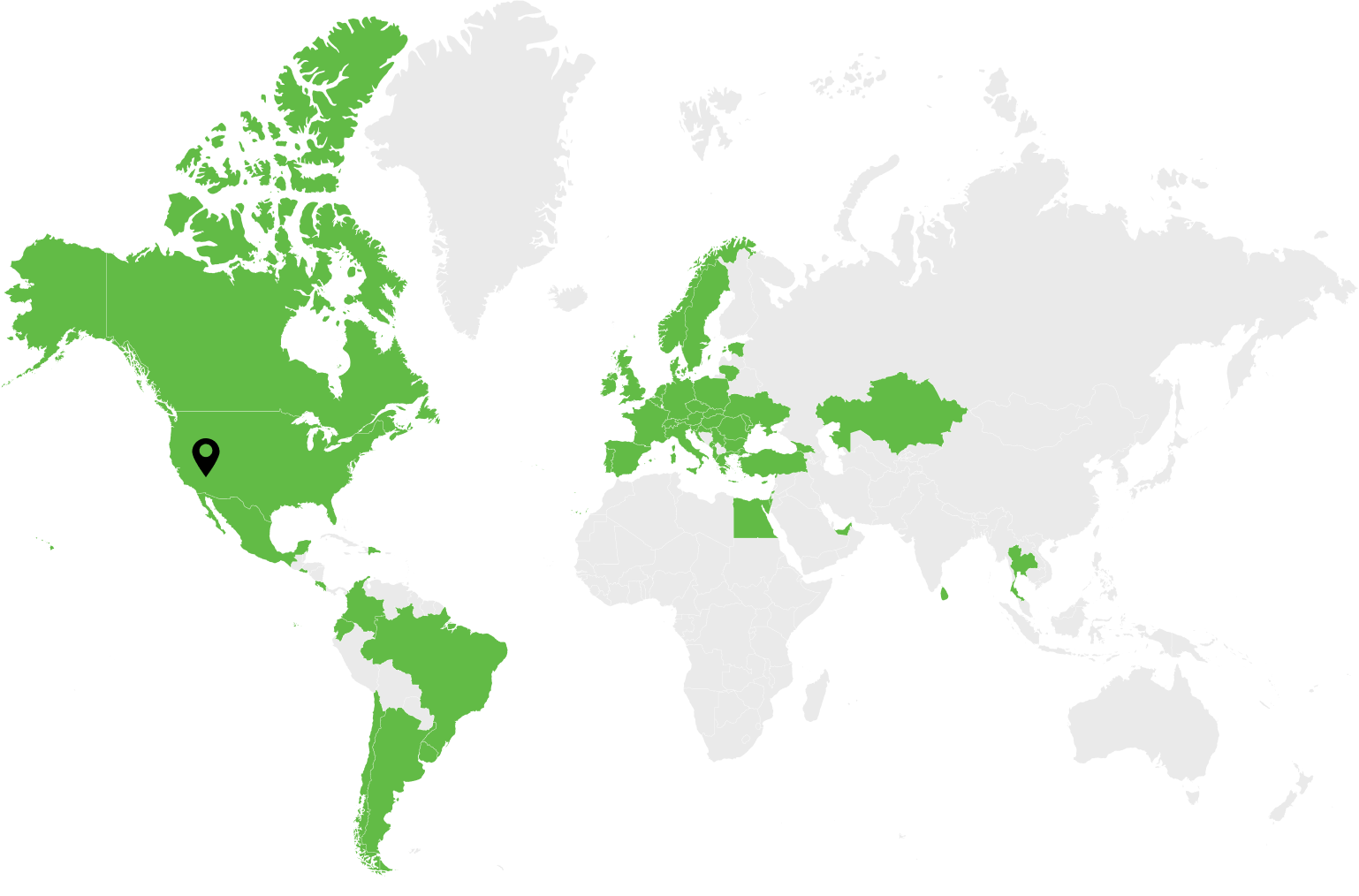

Regardless of industry, skill gaps and legacy constraints shouldn’t stand in the way of digital transformation. Dev.Pro pairs deep blockchain expertise with proven system integration and legacy modernization capabilities to take smart contract initiatives from concept to production.

Contact us today to get started!