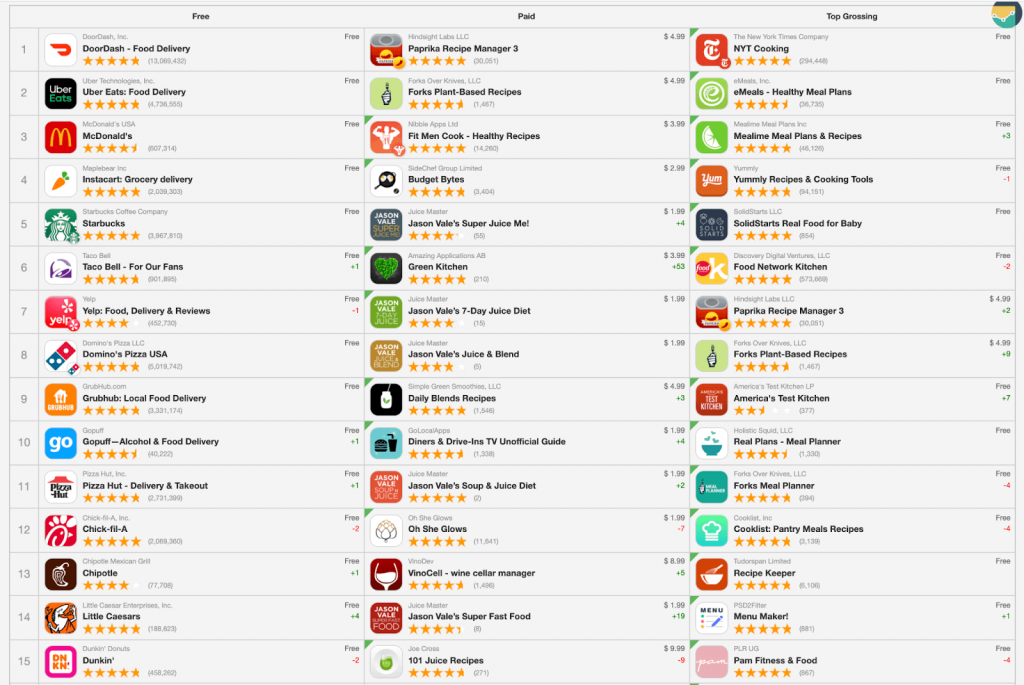

As the food delivery apps like DoorDash and UberEats continue their growth in 2022, the USA’s favorite restaurant brands continue investing in proprietary automated restaurant ordering systems and applications.

With the onset of mobile food ordering tech, speaking to a live agent over the phone is as distant a reality as dialing a number on a rotary phone.

Instead, we are spoiled by user-friendly apps that have images, prices, discounts, loyalty programs, and convenient filtering by location, price, brand. We can arrange food delivery on the go, pay online, and even track a pizza as it goes into the oven.

No app? No problem, you can use a website ordering system, get an SMS confirmation, track your order on a restaurant site, get your burger with no onions, just as you like it — without ever speaking to a human being.

It all sounds easy from a customer perspective, however it’s a cut-throat business for food operators and delivery services. As the market matures and players like DoorDash and Deliveroo go public during the lows of pandemic, there’s significant consolidation happening with M&A deals [like GrubHub acquisition by Just Eat for $7.3 billion, and Uber Eats acquiring Postmates for $2.65 billion].

Large fast food chains, like McDonalds, Starbucks, Dominos, Dunkin Donuts, Wendy’s are competing with the delivery aggregators by developing and promoting their brands’ automated restaurant ordering systems.

McDonald’s core growth strategy aims to double down on the 3Ds [Delivery, Digital, and Drive Thru]. With its massive scale — 120 countries, 33,000 outlets, and 60 million users — scaling its tech is a top priority. One of the digital transformation cases for this fast food behemoth includes MCdonald’s Hong Kong’s acquisition of 1.8 million digital users in just 4 months, thanks to a highly successful Facebook campaign.

In this article we’ll look at automated ordering systems software development in detail. Read on if you want to know the answers to these questions:

What tech stack is used for these solutions? Which features are must-haves? What’s the algorithm for building an automatic ordering system? What vendor or third-party tools are integrated with each other to make automation seamless?

Online Food Ordering Apps: Investors’ Magnet for Years to Come

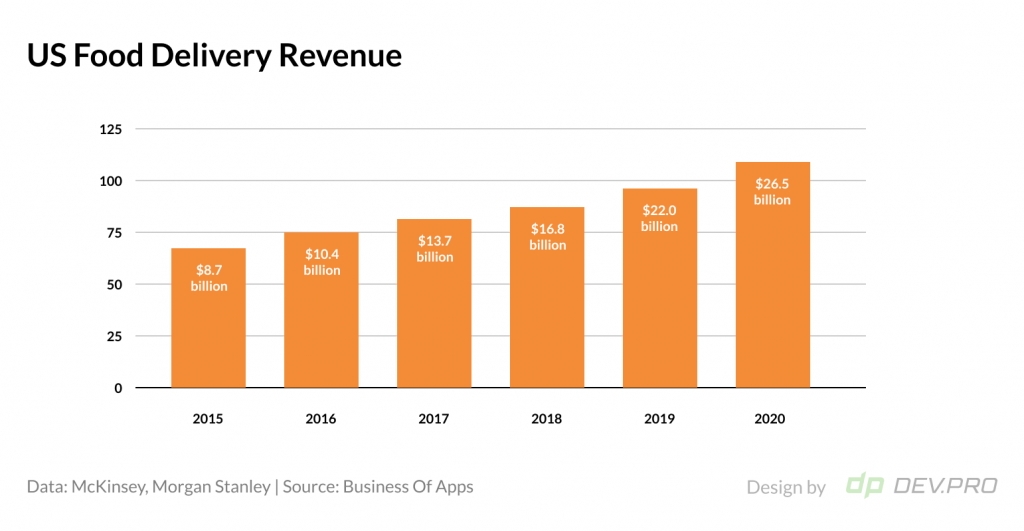

The boom in Restaurant Tech is a silver lining to the pandemic cloud for the food and beverage [F&B] industry. Eating out habits changed drastically overnight and food tech has seen an influx of investment, with food ordering and delivery services leading the way.

- US food delivery revenues have been growing steadily, adding 20% between 2019 and 2020 to reach $26.5 billion. User numbers have also increased over the years, from 66 million in 2015 to 111 million in 2020. This means that 1 in 3 people in the US actively use a food delivery app on their smartphone.

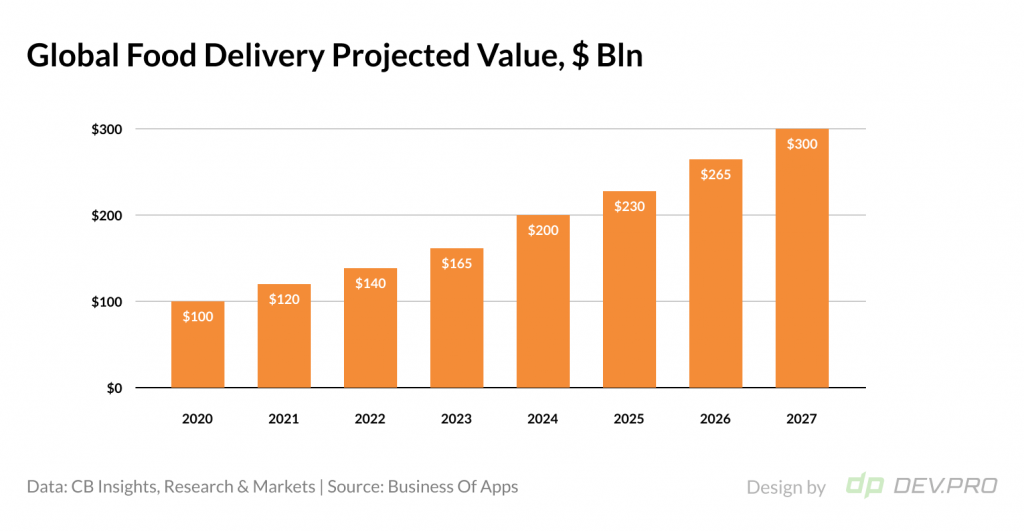

- CBInsights found that food ordering and delivery systems are still in their early days and predicted a continuous, vigorous growth over the next 7 years. This reputable think tank expects global revenues to triple from $100 billion in 2020 to $300 billion by 2027.

Even though automated restaurant ordering systems are just now nearing mass adoption, there’s enough user data for the main features to have crystallized as the golden standard for the industry. Let’s consider them.

Must-Have Features for Automated Restaurant Ordering Systems and Apps

The main differences in these types of solutions come from these factors:

- Proprietary software by a food operator vs. marketplace type delivery [Wendy’s vs JustEat: delivery service logistics, payment, loyalty programs, ranking algorithm, table reservation feature, monetization and commission modules, merchant dashboard etc].

- Geographical location [USA vs China: different payment systems, currencies, cloud service providers, social media integrations, etc].

- Quick Service Restaurants vs FSR: [SubWay vs Nando’s: table reservations, loyalty program, delivery, takeout modules]

- Speciality differentiator [Pizza vs burgers vs sushi: topping module for pizza, DIY customization feature for burgers]

Apart from the differences in the mix and types of technical features for automatic ordering from system to system, the following modules are staples in the industry:

Menu Options in Restaurant Ordering Systems

- Catalog of merchants with respective data fields and images

- Catalog of dishes with predefined information fields and images

- Sorting and filtering options [by cuisine, location, budget, by starter / dessert / main dish, etc.]

Food Ordering Module

- Table service option to reserve a table, note preferences, special occasion, or cancel a table

- Delivery module to manage communication between the merchant, user, and driver

- Takeout alternative to manage takeaways and curbside pickup

- Website integrations and a mobile app

- Integration with notification center to send out automated messages in the predefined channel [WhatsApp, sms etc].

Payment, Commissions and Invoicing

- User payment features will entail a breakdown and calculation of prices for orders food, commission, and fees

- Payment system integration with a set of contracted payment methods [PayPal, Visa and MasterCard, Apple, and Google Pay]

- Order refunds and cancellations

- Merchants and drivers will also have accounting and invoicing features

Reporting and Analytics

[differs depending on the role: merchant, driver, user]

- Merchant: Daily sales, bestsellers. Average check, commissions

- Delivery associate: weekly, daily rides, deliveries, commissions, fees

- Order history, payment details, coupons and discounts applied

Review and Rankings

[this feature can be applicable to food, merchant, driver, user]

- Ability to leave a review and rank a restaurant, as well as driver

- Ability to read reviews and view rankings on multiple touchpoints: merchant catalog, restaurant page, and dish page

Loyalty and Support

- Order stats

- Personalized offers

- FAQ

- Premium subscription details [for example, Eats Pass and DashPass]

Revenue Management Features

- Coupons and personalized discounts

- Peak hours bonus for drivers

- Small order fee management

- Price comparison with other apps to offer the best deals for bargain-sensitive users who shop multiple apps before ordering

- Merchant offers and deals [BOGO, get X% off if you buy Y items, get X% off if you buy in happy hours, and first-time buyer deals]

- Regular customer bonuses

- Weekly / monthly subscriptions plans

Heat Map and Map Modules

- Users can see restaurants on a map

- Drivers can see a heatmap of busy and super busy areas, schedule their shifts and book slots for delivery

Delivery Management

- This feature allows merchant to receive orders per menu and process it

- Order cancellation

- Order pick up and courier management

Chat and Notification Center

- Automated notifications as the order gets processed

- Real-time push notifications for time-limited deals and promos for location-based targeting

QR Code Food Ordering

- QR code use for marketing

- QR code use for contactless ordering and menu reading on-site

Social Media Integration

- Meta integration for Facebook, Messenger, and Instagram ordering and promos

- TikTok integration for promotion and advertising purposes

Third-Party Integration

- Integration with third-party apps, like HRM systems, accounting, and CRMs

IoT Integrations

- Barcode scanners

- RFID

- Camera sensors in kitchens

Read our in depth article on use of IoT for restaurants.

Account Management & Access Management

- User account

- Merchant account

- Driver account

- MFA, role-based authentication for merchants and drivers

Automated ordering systems for restaurants need to have smooth integrations so that all processes and notifications flow smoothly from one stage to another.

Steps to Build Your Automated Restaurant Ordering System

If you task your team with developing a fully automated ordering and delivery app for restaurants, your starting point and business requirements will define the timeline, budgets, and operational constraints.

If you have to build an automatic food ordering systems from scratch, your team will follow these milstone steps:

- Project discovery phase: Ascertain the scope of work, gather business case requirements as perceived by major stakeholders, scrutinize market, competitors, conduct user interviews, create user avatar, and design a high-level project roadmap.

- Plan: This is when you take all of the facts and findings of the project discovery stage and make conclusions and plans based on them. A team, milestone actions, budgets, timelines, tools, and resources need to be defined at this stage.

- Design stage will result in high-level design and architecture as well as a low-level design for system components. The team will have a set of detailed documents to enable the development stage, which includes:

- System design document

- Plans: DR, security, training, conversion, unit & integration test plans, and implementation document.

- Manuals: Maintenance, Sys Admin, and User manuals

- Requirement traceability Matrix

- Development & Testing: When all the tools and team are ready and systems are procured and configured, the code building process begins. Thanks to cloud-native software development, CI/CD processes are usually implemented and automated testing starts as early as possible.

- Deployment stage results in the code are deployed to the production environment and feedback is gathered from users and developers for continuous improvement.

- Integration with Third-Party Systems, IoTs may take place at an earlier stage of the SDLC, as automation suggested seamless two-way communication of multiple solutions.

- Maintenance, Security, Updates are also a continuous endeavor in the modern hospitality software development life cycle as new commits, and software releases are frequent. DevSecOps integrates security as part of the continuous deployment practice.

While this is just a high-level overview of how to build a restaurant automation system for food ordering and delivery, some companies prefer to outsource software development to tech partners with experience in the F&B industry.

Where to Begin?

There are many risks for restaurant automation systems at each step of the process: from ideation to maintenance. Whether you have to start building it from scratch or want to modernize your current solution, there are key architectural and vendor decisions to be made that will impact the cost, resilience, and availability of systems for years to come.

Unless you have a strong team with vast experience in large-scale software applications, you may want to consider hiring a software development partner that is well-versed in mobile app development and cloud technologies. Even if you involve these experts for the initial discovery and design stages, the ROI will be enjoyed for years to come.

Dev.Pro’s team has helped a number of clients develop SaaS applications and proprietary software solutions for hospitality and SMB. Some examples include Lavu POS, which features the POS-related background, and Global Payments. These cases demonstrate our portfolio from reporting and payment system integration angles.

Discuss your project with our tech-savvy sales associates to obtain estimates with a timeline and budget for your automated restaurant ordering solution development.