mPOS [mobile point-of-sale] systems allow smaller businesses and those on the move or in the field (food trucks, market stalls, repair professionals, taxis, doctors, or couriers) to make legal registered transactions. For the customer, it’s another reason to choose a business outlet over a competitor that only takes cash, or doesn’t offer NFC-enabled payments like Apple Pay.

In recent mPOS terminal market research, GMInisghts estimates that the global market size for mPOS terminals will exceed $25 billion in 2022, with hardware taking up just over three-quarters of the total.

The research also projects an ambitious ten-year growth span at a CAGR of 10% to reach $100 billion by 2032. The drivers behind such a sustainable expansion are further adoption of cloud technology, EMV card payments, and NFC-enabled transactions. The growth of retail and ecommerce is fertile ground for these developments, as demand grows and stimulates supply.

According to another reputable study by Juniper research, at least one-third of all POS systems used worldwide in the next five years will be either a tablet or a smartphone.

This is Dev.Pro’s insight into mPOS development—we’ll review the main trends, benefits, features, and vendors.

What is mPOS?

mPOS is a mobile software application that enables users to register transactions and process payment via a mobile device. mPOS hardware comprises over three-quarters of global sales.

mPOS is mostly used by SMB, for example medical staff, plumbers, delivery services, and taxis drivers. The hardware components may include the mobile or tablet, the dongle, and a card reader.

Soft POS is a newly emerging technology and subcategory of the mobile point of sales systems that turns any smartphone or tablet with an NFC feature into a point-of-sale system, once the software has been installed and activated. Six million merchants used Soft POS in 2022 and the user base is expected to grow to 34.5 million by 2027.

Benefits of Mobile POS for Businesses

What makes mobile Point of sale devices so popular?

Portability

The possibility to accept payments on the go is a huge advantage for many mobile businesses like delivery services, furniture removal, or food trucks.

Modern card readers are designed as small pocket-sized gadgets or a dongle that connects to your phone or tablet.

Cost [Hardware and Fees]

The mPOS hardware is rather small compared to desktop stationary solutions, so even the mobile POS device is usually on the less pricey side of the spectrum.

Many mPOS vendors will also offer SMB-friendly pricing with no upfront costs, monthly fees, or other scary contractual obligations like early termination fines. Most vendors will only charge their customers a flat transaction fee of about 3%.

Data & Reporting

Many small businesses, like traders at festivals and chefs in food trucks, no longer need to use a notebook to manually sum up totals at the end of the day.

Point-of-sale software has some basic analytics and reporting features that allow entrepreneurs to understand their monthly stats, pick their bestsellers, and drive their average check based on the data.

Employee Management

Major developers of mobile point of sale software and hardware solutions will also include some basic user management profiles that allow you to schedule and time track your employees.

And the capability to see who your best-selling team member is allows you to create an incentive program as well as open a Center of Excellence to recreate the success in other chain outlets.

Inventory Management

Running out of your popular items in the middle of a busy day may seem like a minor inconvenience until you calculate lost revenue and multiply it across the number of busy days in a month.

The ability to track what’s on hand and what moves really fast allows you to stock just the right quantities for your business to run smoothly with no understocking or overstocking issues. Not only will this result in better supply management and less courier services but also keep your regular customers coming back for their favorite items.

mPOS Development: Design Features

Smaller screens dictate their own design priorities. In the case of mobile point-of-sale frameworks, limited time for transaction processing adds another layer of complexity to limiting pre-requirements.

Findability

The users of these systems often need to complete a transaction quickly or on the go. Intuitive interface is critical. Functions and products should be easy to find.

Clear Navigation

Along these lines, a savvy UX designer will ensure that all navigation elements are clear, visible on a smaller screen and located habitually to an average user. So that a user doesn’t need either to decipher how to go back one step or end up lost for next paths from a specific screen.

Consistency in Design

Users can quickly flip through a smaller app with a few major screens when processing the final stage of the customer journey, registering a transaction. Using consistency in mPOS design is vital for ease of use. Similar colors, fonts, arrow styles, and clear visual hierarchy in elements like shapes and buttons are all fundamental.

Use of Icons

Icons are easier to comprehend at first sight, but they are even more intuitive for a habitual user. Use of icons on smaller screens enables quicker processing from one step in the transaction to another. Icons for “Card,” “Back,” “Next,” “Accept,” “Checkout,” “NFC-friendly,” and “Cancel” are a staple and familiar to any user, for example.

Finger-tip Friendly Size

If you are using a smartphone, tablet, or an mPOS terminal, on-screen clickable elements should have appropriate spacing between them. Most importantly, all buttons and interactive elements should be big enough for a finger tap. According to research described by the Nielsen Norman Group, for one-handed thumb use on mobile devices, touch targets on screen should be 1 cm X 1 cm wide [0.4 in X 0.4 in].

Larger Fonts

Many of the steps in an mPOS transaction processing workflow are consequential and require either a simple one-tap confirmation or a selection among a few actions [like confirm or cancel, choose method of payment, insert PIN, print receipt]. This process makes it easy to keep the fonts big on the screen. If a user just needs to keep tapping yes or choosing between a few icons, the heading can be designed in a big bold font.

No Clutter in mPOS Development

Less is more is a great motto for many missions, but it’s an absolute must when it comes to the design of a mobile Point of Sale tool. Keep each screen brief and to the point. This is not a place to persuade, sell, or attract – so make sure there’s no marketing CTA or legal fine print clutter – just operational, accounting, and financial must-have content.

Four Pillars of the mPOS Development Experience in 2023

Software [POS app]

Cloud-native point of sale tools are far from dominating the market but they are a top choice for those POS development companies that are creating the future of transaction processing.

Cloud-based solutions are more widespread as the middle stage between the cloud-native and on-prem solutions.

When it comes to mPOS devices, most are supposed to have some sort of wireless connection anyway, making them even more cloud friendly.

Apart from payment processing, mPOS software will usually feature these capabilities:

- Inventory management

- User management

- Reporting

- Integration features and API

- Receipt printing

- Payment processing

- Loyalty & marketing

In many cases, users can download this software free of charge on a company website, Google Play Market, or Apple store.

Hardware

Card reader and terminals and the major two pieces of hardware when it comes to mobile POS systems. Some smartphones and tablets can function as a soft POS if they have NFC technology embedded in their model.

Credit Card Processing

Popular mPOS Payment options include:

- Major debit and credit card processing [magstripe and chipped ones]

- Contactless NFC enabled payments [Apple Pay and Google Pay]

- QR codes, payment links

- PayPal and Venmo

- Some will have a capability to legally register cash transactions, too.

Connectivity

Most devices in this category will be able to connect via 4G or Wi-Fi. Some terminals will have a preloaded and activated SIM card with mobile connection included in the pricing plan.

Bluetooth is often used to enable data exchange between pieces of hardware.

mPOS Integration: Keeping Connected On-the-Go

These portable friends of a merchant are not supposed to have tones of integration, as they are limited in functionality by their use and definition.

However, it’s not uncommon for major vendors to have the possibility to connect key systems, like:

- Accounting software

- eCommerce software / website

- third party apps

- Notification / marketing software

In some cases, companies prefer to create mPOS software from scratch to use as a soft POS. Let’s review major milestones in the process.

How Do You Develop a Mobile POS?

While mobile application development is not an easy, quick, or cheap task, sometimes it’s cheaper to develop an app once and then keep saving on the transaction fees. Case in focus? Say you have a food truck franchise, and you don’t like the idea of paying an extra fixed fee for each small transaction you run – as your margins are thin anyway. Even if 50–100K for developing an mPOS application sounds like a lot, you may as well get your positive ROI in a few years’ time.

So, here is a shorthand algorithm:

- Define General Project Scope

Decide on the features you need to have by checking out major solutions. You can always add more features later, so having a few fundamental ones to start with is a good idea.

- Choose Development Team

If you are going to try and create this software with your inhouse team or outsource it to a software developer with POS cases, like Dev.Pro – make sure to get a clear understanding of how long it’s going to take and how much it would cost.

- Do a Proper Discovery Phase

Now that you have a team responsible for designing the app, build on that initial draft scope of the project to create a more nuanced understanding of the market, products, timeline, team composition features, and budgets.

- Design Your Mobile Application: Low Fidelity / High-Fidelity Prototypes

The design stage can be rather thorough if your discovery stage confirmed that creating a custom mPOS is what your company needs and can afford. If you are still unsure, and you are going all in with the project but need to present some more tangible outline to the C-suite, low-fidelity prototypes may be a good fit to serve the purpose.

- Develop the Software Solution

mPOS development can take as little as up to six months depending on the tech stack, team composition and features chosen for the initial version. Tech stack choice is important here. Compatibility with Android and iOS is critical, too, if your market dictates both. Some markets are primarily Android / iOS and a company may get away with just one version to start with.

- Test and Deploy

Performance testing, load testing, integration, and security testing are just a few of the ongoing tasks for DevOps from this stage on as part of the CI / CD best practices. Deployment also includes the strategic decision of where to host your application in terms of infrastructure management as well as cloud service provider. Payment gateway integration also occurs in this stage. Testing will also take place on the hardware of choice, be it a mobile, a tablet, or a terminal.

- Integrate and Maintain

The final stage is all about updates, integrating the system with third party tools, and ongoing enhancements.

If you are only considering whether you need to invest all that money in developing a new solution or your company is better off with a vendor-made solution, talk to one of our experts.

Dev.Pro – mPOS Development Company

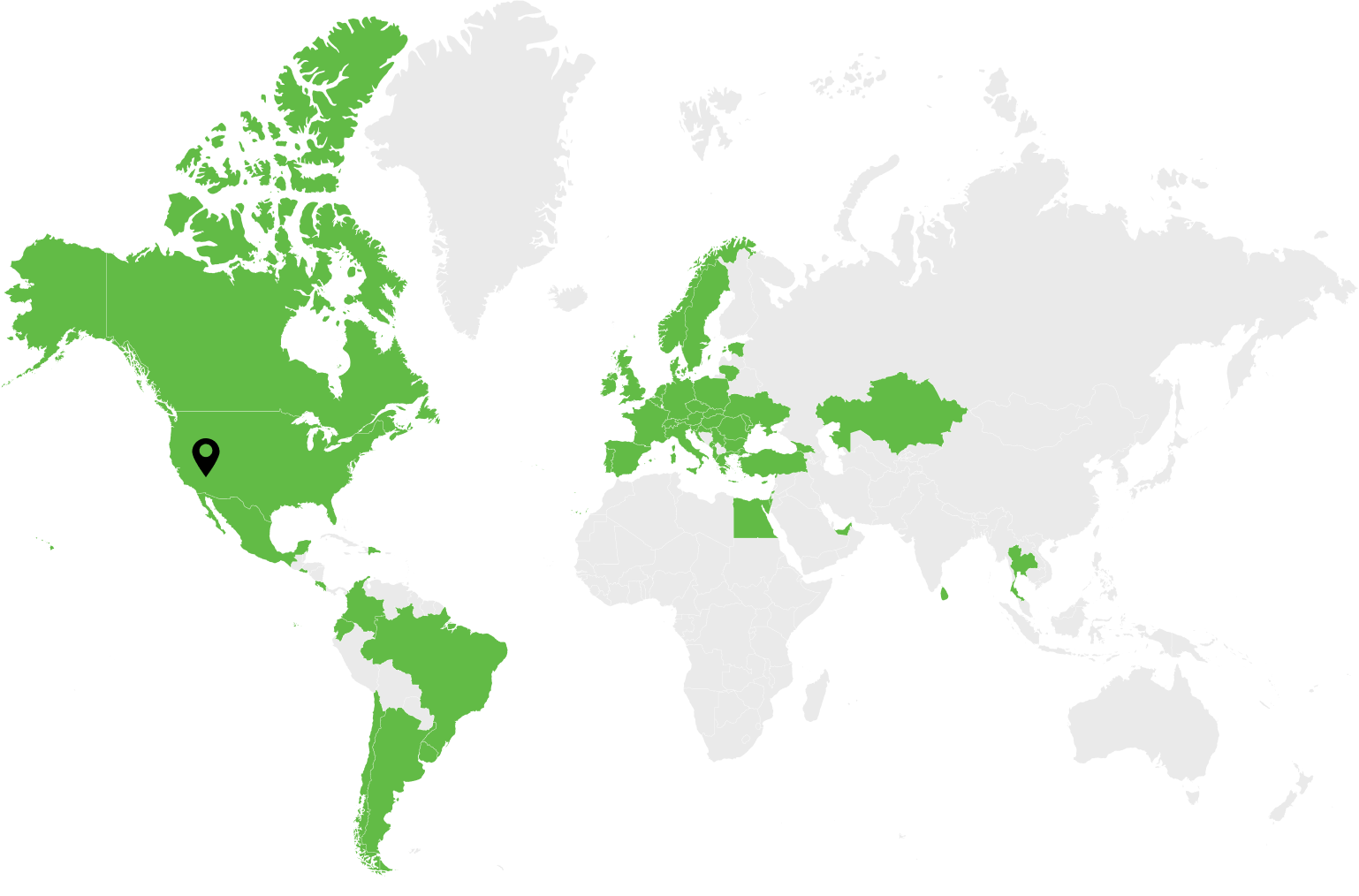

Dev.Pro has developed a few POS systems in the eleven years that our company has been busy creating ideas into code.

Check out some of the user cases here before calling one of our knowledgeable sales experts for a no-obligation, no-fee consultation.