The value of the annual global money transfer industry is an astounding $900 billion.

Despite the massive scale of the market, money transfer organizations haven’t always kept pace with the latest technologies. This is not a new tale for the financial services space, as novel technologies and consumer expectations often outpace established providers.

When it comes to something as vital as money transfers, financial service providers should take every possible measure to ensure safe and timely transactions. That’s where modern fintech solutions and specialized development partners like Dev.Pro enter into the picture.

Top Technology Barriers in Global Payments

While the essential function of the remittance industry hasn’t changed over the years, new technologies like AI and evolving customer expectations are revolutionizing how money transfers are conducted. Along with these evolutions come a new set of challenges:

Legacy Platforms

One of the biggest problems faced by money transfer organizations is updating legacy platforms for the latest innovations. Older systems often rely on batch processing that handles transactions in scheduled cycles, as opposed to real-time. Fintech experts report, “a multinational company waiting 2–3 days for a cross-border payment to settle is not just inefficient; it can cripple operations, delay payrolls, affect supplier relationships, and limit growth.”

Manual Workflows

An overreliance on manual workflows greatly increases error rates for money transfers and reduces overall efficiency. As McKinsey & Company tells us, outdated administrative workflows can consume 30-40% of a team’s total productivity. In some instances, a remittance network handling thousands of transactions daily could lose nearly half of its operational capacity to manual data entry and reconciliation tasks.

Compliance & Regulations

Fintechs operating in multiple global markets must navigate a maze of financial regulations. Every jurisdiction has unique Know Your Customer (KYC) and Anti-Money Laundering (AML) laws that must be validated in real-time for money transfers. In such environments, even minor regional inconsistencies can delay transactions or trigger costly regulatory penalties. This is noteworthy as financial service companies incurred over $6 billion in fines during 2023 alone.

Fragmented Mobile Ecosystems

Money transfer companies operate across diverse global markets, and users rely on countless device models, operating systems, and network conditions. In fact, the world has over 1,600 mobile network providers across nearly 220 countries. In turn, a feature that works seamlessly in Europe may fail under limited bandwidth in sub-Saharan Africa or South America. Without rigorous cross-platform optimization, performance gaps can undermine reliability and erode user trust.

How Dev.Pro Streamlines Modern Payment Systems

Dev.Pro tackles the most pressing technical challenges in the global money transfer industry, modernizing infrastructure, automating workflows, and ensuring secure, scalable performance.

Cloud Deployment & Modular Microservices

By employing cloud-native architectures and modular microservices, Dev.Pro helps clients realize critical digital transformation initiatives, while also achieving faster deployment cycles and greater system flexibility.

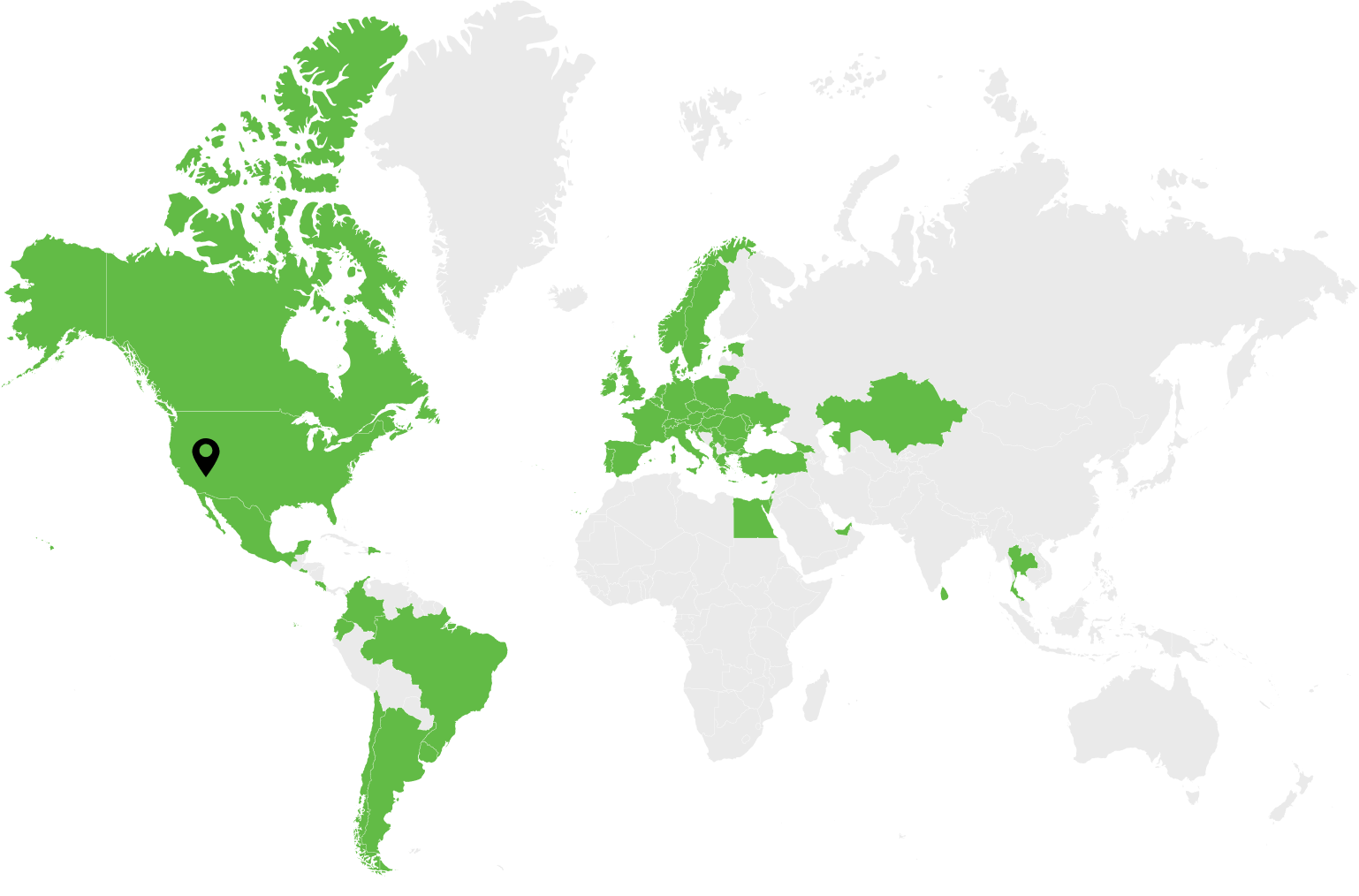

Since uptime, scalability, and regional performance are critical in the global remittance market, cloud-native architectures tailored for high-volume remittance traffic enable local data processing in key regions like Latin America, Europe, and Southeast Asia. By leveraging AWS and Azure availability zones, Dev.Pro reduces transfer latency, ensures regulatory data residency, and maintains 99.99% uptime during peak transaction periods.

Smart Automation

Dev.Pro prioritizes AI automation to eliminate the challenges with manual workflows that plague the global remittance space. With transaction validation, error detection, and data extraction, we help clients realize the speed and precision that today’s tech-savvy customers have come to expect.

Using Generative AI and Natural Language Processing (NLP), chatbots handle balance inquiries, fee estimates, and transfer updates in real time. Moreover, Dev.Pro employs predictive analytics so money transfer clients can anticipate transaction surges, optimize staffing, and improve system performance.

Compliance Ready Architectures

Global money transfer companies are charged with meeting strict standards like PCI DSS, SOC 2, and GDPR while protecting sensitive financial data across borders. Dev.Pro builds security tools directly into the transaction pipeline to keep remittance organizations compliant at all times.

Our specialists embed security-by-design principles into every application we build, using threat modeling, secure code review, and DevSecOps automation. Dev.Pro conducts 360° web and mobile security audits aligned with OWASP and industry frameworks, ensuring systems remain compliant and resilient as regulations evolve.

System Integrations

Dev.Pro specialists create integrations through custom APIs, SDKs, and microservices to ensure every financial transaction syncs in real time, whether initiated in Nairobi, Madrid, or New York. By combining event-based webhooks and automated orchestration tools like Terraform and Ansible, Dev.Pro delivers secure, cross-platform environments that perform consistently across Android and iOS, reducing latency, data loss, and operational silos.

Case Study: Ria Money Transfers

Our partnership with Ria Money Transfers is a prime example of Dev.Pro’s efficacy in the remittance industry. Operating across 165 countries and serving millions of users through over 500,000 agent locations, Ria is one of the world’s largest money transfer organizations.

The Challenge

Ria’s existing agent app was outdated and functionally limited. Agents across the world relied on it for core transactions, but the system’s legacy design slowed operations and restricted scalability. The company needed to increase transaction speed, simplify user workflows, and standardize the agent experience across global markets, all while maintaining strict compliance and reliability standards.

The Solution

Dev.Pro redeveloped the Ria Agent App from the ground up using Ionic 7, a cross-platform framework that enables simultaneous iOS and Android releases.

Our engineers collaborated closely with Ria’s product and backend teams to implement Agile development cycles, structured QA processes, and continuous delivery pipelines. To ensure transparency and quality, Dev.Pro introduced new processes for ticket management in Jira, Git-based version control, and clear project documentation.

The Result

In our engagement with Ria, Dev.Pro delivered a multi-functional, experience-driven tool that transformed how Ria agents operate worldwide. Results include:

- Performance & Efficiency: Streamlined transaction workflows reduced manual input to improve processing speeds

- Quality & Reliability: Decreased production defects and improved app stability

- User Experience: Achieved a 4.8+ app store rating with iOS and Android users

- Agility & Scalability: Incorporated real-world agent feedback into monthly releases for quick market responsiveness

- Cost Savings: Delivered measurable development and maintenance efficiencies with the Ionic 7 cross-platform framework

Revolutionize Modern Money Transfers with Dev.Pro!

Especially when it comes to cross-border transactions that support families, businesses, and economies, money transfers are a lifeline for millions of people globally. Yet, problems with outdated infrastructure, manual processes, and compliance frameworks hinder even the most established remittance providers. Luckily, Dev.Pro has the fintech solutions and specialized skills to help money transfer companies meet even the most rigorous digital transformation initiatives.

From cloud deployment to mobile modernization, Dev.Pro helps global remittance organizations like Ria Money Transfers transform legacy systems into scalable, secure, and high-performance platforms. Whether you’re improving agent efficiency, reducing transaction latency, or expanding into new markets, our engineers deliver the technology to make it happen.