The AI fintech market is expected to grow by an incredible 400% between 2023-2032.

From hyperpersonalized customer service to highly scalable fraud detection, AI has near-endless potential in fintech. Yet, while the power of AI is undeniable, there are concerns about using it in a way that respects people’s privacy, keeps data secure, and meets compliance laws.

Due to the highly sensitive nature of financial data, trust isn’t just a “nice to have” in fintech; it’s a foundational element of a functional industry. To use AI to its fullest potential, fintech companies must explore ways to find a balance between innovation and responsibility.

Potential Challenges of AI in Fintech

As the fintech industry has grown and evolved, providers are learning some hard-won lessons when it comes to privacy, security, and compliance. In recent years, agencies like the SEC and EDPB have scrutinized these businesses more heavily.

- 60% of fintechs in 2023 reported paying $250K+ in compliance fines

- 93% of fintechs claim the Bank Secrecy Act (BSA) is tough to meet

As fintechs ramp up their use of AI technology, consumers and businesspeople also have their concerns.

- Nearly 50% of financial services professionals are concerned about privacy and security threats posed by AI.

Although data privacy and security risks are widely recognized, fintech businesses and customers alike are embracing AI-driven technologies with confidence and enthusiasm. With so much potential for both good and bad, the key question becomes: how do we strike the right balance between innovation and responsibility?

A Closer Lookt at AI in Fintech: Specific Use Cases

Looking at specific use cases for AI in fintech provides valuable insight on aligning innovation with compliance and trust. By weighing both benefits and challenges, we can get a clearer picture of viable solutions.

AI Chatbots & Personalization

AI chatbots use natural language processing (NLP) to interact with users via text or voice. They handle tasks like answering questions, assisting with transactions, and providing account information.

- Benefits: AI-powered chatbots help fintech companies enhance customer service and cut costs on support desks. Users enjoy chatbots for their 24/7 availability and instant responses.

- Challenge: AI chatbots have limited understanding of nuanced or emotional queries. Similarly, overdependence on AI can create barriers to human assistance, resulting in customer frustration.

- Solution: Human agents should always be available to back up AI chatbots without too much effort on the part of customers.

Fraud Scoring & Risk Management

Fraud scoring and risk management in fintech use AI and machine learning algorithms to evaluate the likelihood that user behavior is fraudulent or poses a financial risk.

- Benefit: Since they can rapidly analyze large amounts of data, AI models can spot fraudulent activities in “near real-time.” The basis for fraud scoring is often weighing online activity versus established behavior and spending patterns.

- Challenge: Incomplete, outdated, and biased data can significantly undermine the accuracy and reliability of risk assessments, risking legal and regulatory violations.

- Solution: Be sure to test data accuracy and quality before training AI models for risk management. Regularly test your systems to ensure that their output is accurate and compliant.

Robo-Advisors & Financial Planning

Robo-advisors in fintech utilize algorithms to provide detailed financial advice to customers on investment portfolios and financial planning services.

- Benefit: Using variables like income and expenses, these platforms make long-term financial planning faster and more accurate.

- Challenge: AI’s power depends on access to detailed personal data like spending habits and transactions. This level of access raises concerns about personal data privacy.

- Solution: Fintech providers address privacy concerns by implementing transparent data policies, offering opt-in features, and using secure data processing.

Conclusion

It’s predicted that AI will add $200-$340 billion annually to the financial services industry through increased productivity. While the immense financial benefits are undeniable, AI technology potentially poses real threats to privacy, security, and compliance. All things considered, the question isn’t whether to adopt AI, but how to do so in a way that maximizes value while minimizing harm.

Since trust is paramount to success in fintech, providers must go above and beyond when it comes to privacy, security, and compliance protocols. While additions like opt-in features and transparent data policies are helpful, the key lies in creating practices that go far above basic compliance requirements. In doing so, fintech providers can balance personalization, convenience, and trust.

Ready to Build Intelligent, Compliant Fintech Systems?

AI implementation in fintech is a double-edged sword. While the financial benefits are obvious, the many threats are often more difficult to see.

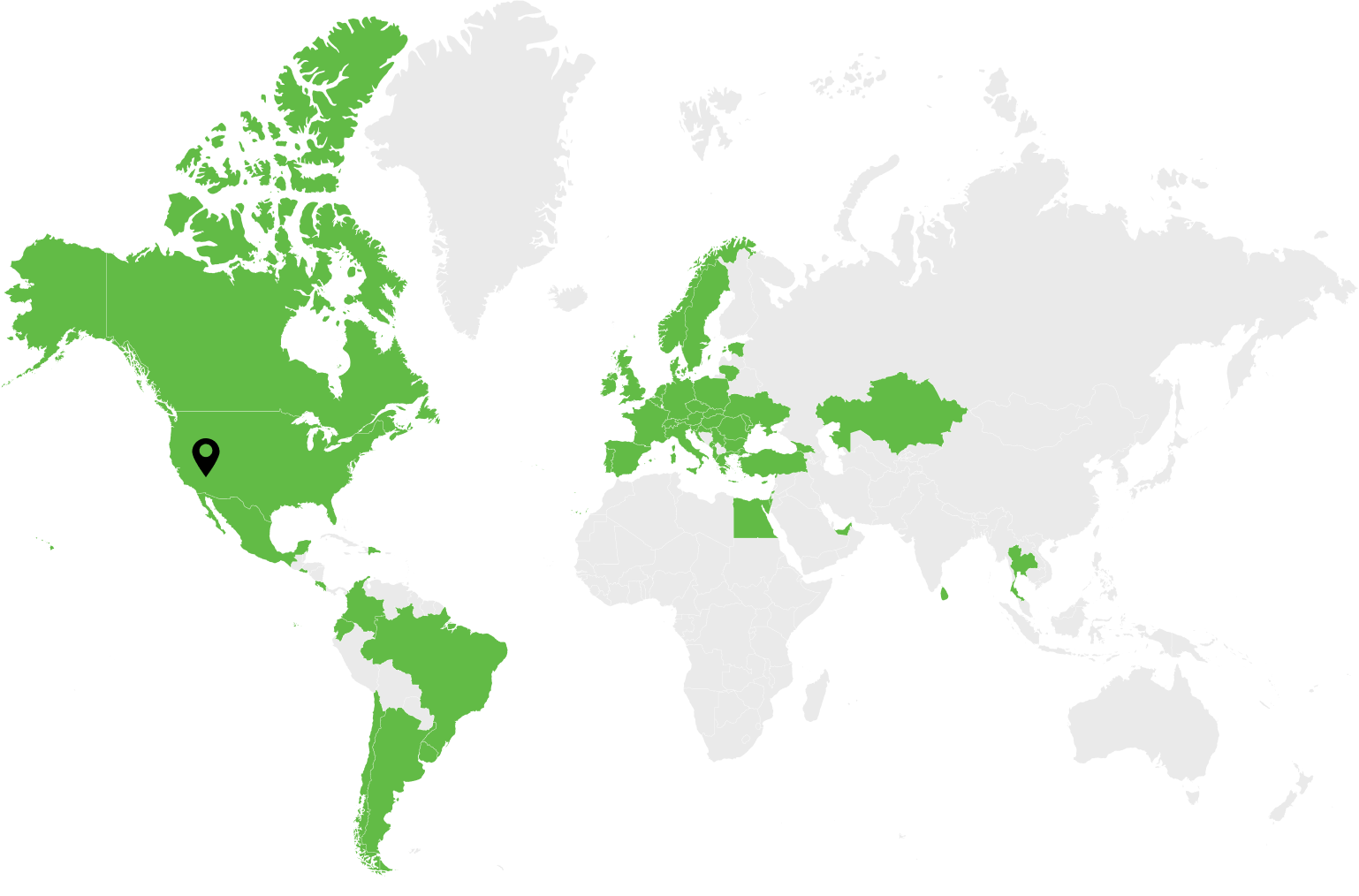

Working with a skilled outsourcing or outstaffing partner is a great way to overcome knowledge gaps with new technologies and industry requirements. Dev.Pro combines technical expertise in AI with domain knowledge in fintech to deliver custom software that meets both business goals and compliance standards.

Let’s talk about your next fintech project!