Restaurant accounting software is now available in almost every form: SaaS and onprem, industry-specific and universal, custom and vendor solutions, standalone and tightly integrated with the rest of the IT ecosystem. With multiple vendors, complex taxation, security threats, and high turnover in the industry, restaurant owners expect a user-friendly, secure, multifunctional tool for managing their books.

With 12.5 million people employed in US restaurants alone and $659 billion in sales in 2020, there are a lot of books to keep. In moments of crisis, cost-saving measures only bring more scrutiny to accounting and how to use its levers to control and boost the bottom line.

According to the Toast’s Restaurant Success Industry Survey, at least three of the top 8 challenges for restaurateurs have direct correlation to accounting efficiency:

- High Operating & Food Costs – 52% [challenge #1]

- Laws, Restrictions, and Government Regulations – 23% [challenge #7]

- Understanding My Restaurant’s Metrics – 21% [challenge #8]

When choosing the best accounting systems for restaurants, businesses know they are spoiled for choice in terms of supply, but a few concerns arise:

How much is the monthly subscription and, more importantly, how much are the payment transaction fees?

How can you migrate the old books to the new system for a proper YOY comparison?

Which solution is the best for a chain of restaurants, so that restaurant analytics and reporting can be done on all levels: from geographical split to ownership type?

What’s the best way to integrate an accounting tool with other restaurant software systems: the inventory system, POS, and restaurant payroll software?

Some larger players opt to develop a custom restaurant accounting software, which is costlier and takes more time, but offers flexibility. You can customize features to your business requirements, as well as reduce transaction fees in the long run.

In this piece, we will review the main features, benefits, and reasons to opt for a custom-made tool that helps you manage your books in the food service industry.

What is Restaurant Accounting Software?

Restaurant Accounting Software is a cloud-based, hybrid, or onprem system used for bookkeeping in F&B to track costs and income. These tools help issue, send and receive invoices, manage inventory, price menus, process taxes, and produce reports.

The solution is available as a standalone unit or as a part of universal restaurant management software that includes other enterprise level functions like payroll management, HRM, and POS software.

Accounting System for Restaurant: Market and Trend Analysis

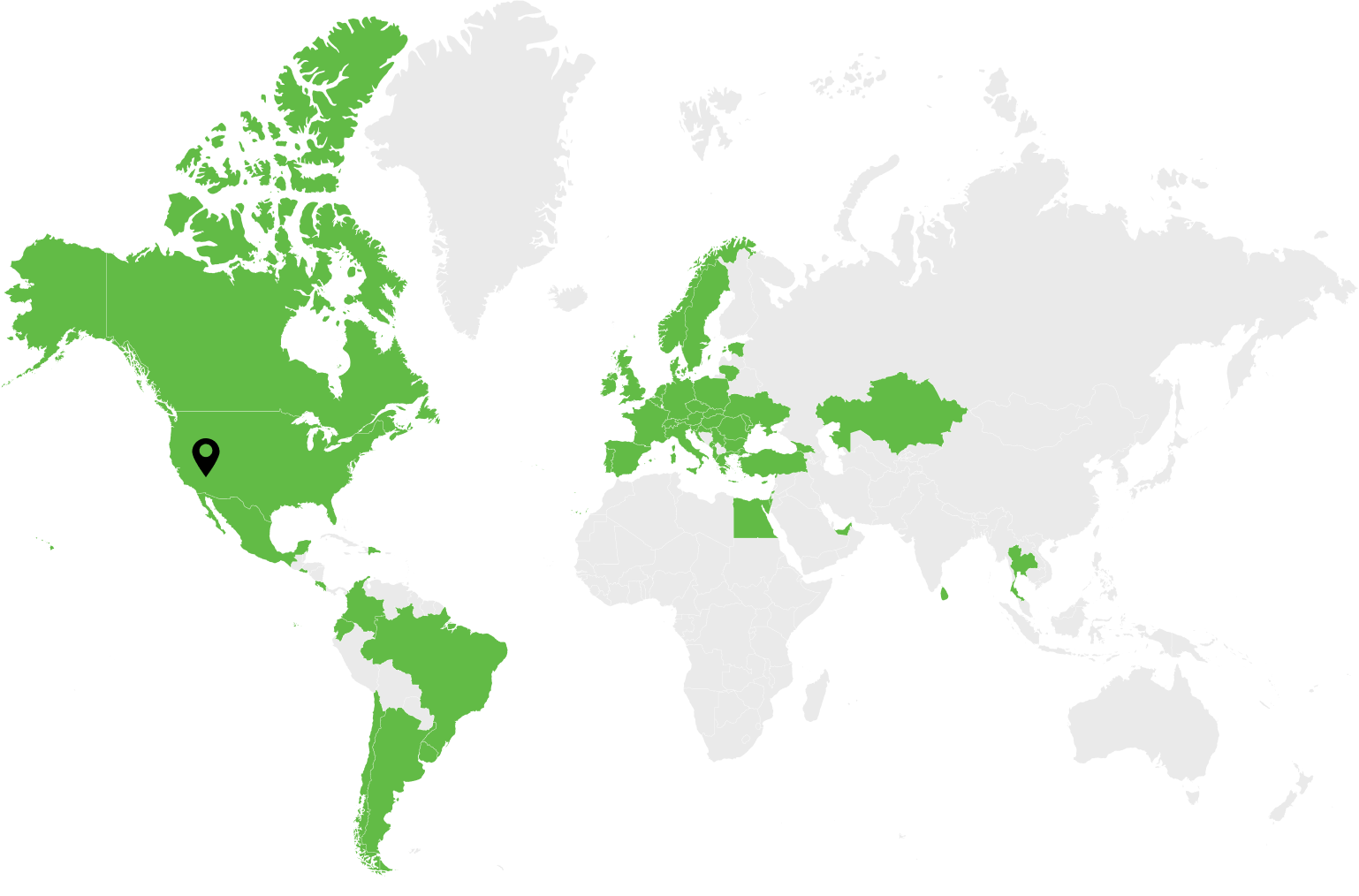

According to Mordor Intelligence, the accounting software market is set to grow from $12.01 billion in 2020 to $19.6 billion by 2026.

The technology is in its mass adoption stage, with 82% of SMB and 58% of enterprises using cloud accounting systems. Moreover, investing in automating your bookkeeping process can prove profitable. The ROI comes in 6-18 months, according to research from Vanguard Systems [now part of MHC Automation].

According to the Codat 2020 survey, the US market is dominated by Quickbooks’s accounting software: its online version is used by 47% of businesses, 17% use its self-employed edition, and another 15% opt for the Quickbooks desktop version. Xero, GoDaddy, and Freshbooks follow at 4% each, with Wave at 3%.

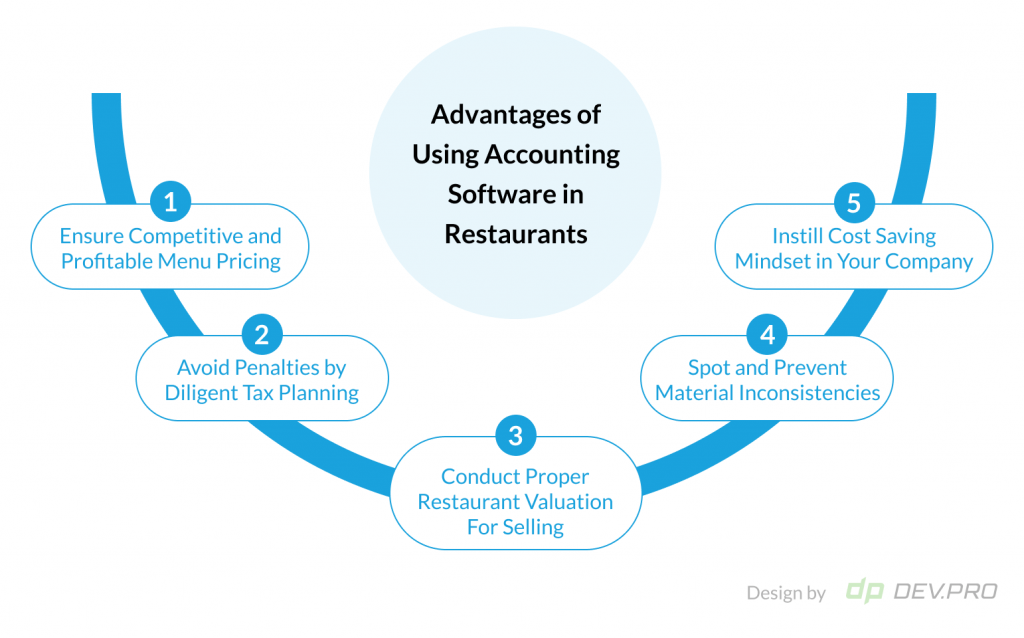

Advantages of Using Accounting Software for Restaurant Business

Automating accounting procedures offer numerous advantages across many facets of business including increasing productivity and decreasing human error.

Ensure Competitive and Profitable Menu Pricing

There are a few factors that go into menu pricing decisions [they’ll have different degree of impact on the bottom line depending on the industry segment, location, season and other aspects]:

- The cost of ingredients their perishability

- The labor cost [some dishes maybe extremely labor intensive with highly skilled members needed for preparation]

- Other costs [e.g.: utility bills for cooking roast beef, or specific equipment – smoking machine]

- Popularity of the dish [if a dish is in high demand, it’s cheaper to buy ingredients and to do mise-en-place]

- Margin for premium sector / central location

Many of these factors can be analyzed, monitored, and adjusted in accounting systems, as they are often integrated with kitchen menu engineering solutions, IMS and POS tools.

Once the food cost is under control and the executive chef gives it the green light, marketing and administration can apply additional discounts or promotions to attract new visitors.

Avoid Penalties by Diligent Tax Planning

In FY2020, the IRS assessed $31.37 billion in civil penalties and abated $23.88 billion.

Most restaurant accounting and payroll software will have tax processing and filing features and integrations, which help automate processes and avoid penalties.

Conduct Proper Restaurant Valuation For Selling

Accounting systems will help prepare and produce the documents needed to sell a franchise, or to evaluate it for the purpose of administering inheritance papers.

Your prospective buyers will need to make their buying decisions based on the specific documents for a few years. Having profit and loss, cash flow, and income statements ready is a good start to a selling routine. Additionally, buyers will appreciate if accounting books are automated as a fundamental part of a digital transformation.

Spot and Prevent Material Inconsistencies

Material inconsistencies may seem like a matter of the past with all the CCTV cameras. However, there are many ways employees can steal from a restaurant: from giving away freebies to friends to false voiding and walking through the door with premium alcohol. Like food waste and natural breakage weren’t enough for business owners.

Automated accounting solutions will have reports nicely designed to specifically highlight any discrepancies in inventory, so that users can timely spot any material inconsistencies.

Employee theft causes 30% of bankruptcies and costs businesses nearly $50 billion a year.

Instill Cost Saving Mindset in Company

We can easily enumerate a dozen more benefits from the implementation of automated accounting systems, but the overarching goal for any restaurant owner is to instill a cost optimization culture in the team.

A chef should know your planned food cost, a chief bartender should be well aware of the optimal drink cost and sales budgets, and a manager should be able to keep manning at bay despite seasonality. Having visual reports and analytics hitting your inbox in customized charts specifically designed for your role helps raise financial awareness and accountability among the team.

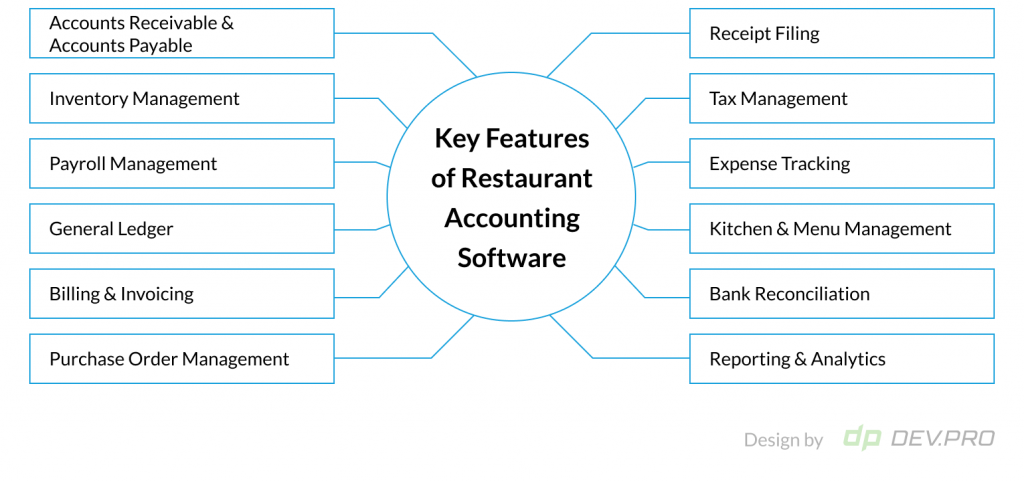

Key Features of Restaurant Accounting Software

There are some age-old aspects of accounting that have been helping businesses make ends meet historically: account payables, account receivables, business payroll, general ledger, and other business modules. Yet, modern restaurant accounting and inventory software will also include other technical and conceptual features, like visualizations, dashboards, use of AI and ML for forecasting, mobile accessibility, cloud deployment.

Accounts Receivable & Accounts Payable

The ability to create an account for your supplier or your clients with all respective bank and contact data. This lets you process transactions, monitor history, or even use predictive analytics for forecasting.

Inventory Management

Most simple accounting software for restaurants will have to be integrated with the IMS, while more complex solutions may have a feature that deals with inventory tracking, signoff, and reconciliation between departments.

Payroll Management

Payroll may also come as an embedded basic feature, wherein each restaurant role will have a rate and hours worked fields multiplied less tax. Sick leave and vacation management are also part of the payroll module.

DevPro’s software architects have experience in developing custom payroll solutions for one of our major clients. Feel free to discuss your needs with our well-versed team.

General Ledger

The general ledger has all transitions and invoices — incoming as well as outgoing — with easy sorting and filtering.

Billing & Invoicing

Users can create, send, and invoice in a system as well as match it automatically with the payment as it arrives. Many advanced tools will offer customization options, so that you can brand your invoices with your corporate style.

Naturally, custom accounting software for restaurants will be tailor-made to suit your business requirement from A to Z: from design to role-based reports.

Purchase Order Management

Creating, editing, printing, and sending the POs can also be done automatically using default or saved templates.

Receipt Filing & Management

Some of the top solutions in the industry, like Quickbooks, have a functionality where users can take a picture of your receipts and attach them to specific invoices and accounts ready for audits and tax filing.

Tax Management

The best accounting software will ensure smooth and automated tax management and filing. VAT, sales tax, GST, local, state and federal taxes need to be applied and processed for all transactions.

Expense Tracking

This feature keeps a record of all expenses, whether it’s a business trip or a new asset for refurbishment.

Kitchen & Menu Management

One of the industry-specific modifications to universal bookkeeping solutions. The kitchen and menu management module allows restaurants to price menus by allocating certain grammage to a dish by ingredients.

Getting food cost under control is one of the major challenges of the food service industry, so a properly developed menu pricing feature is critical for your business’s bottom line and even survival.

Bank Reconciliation

With multiple payments to multiple vendors at different time intervals and random amounts, the enterprise needs to reconcile all accounts, payments, and invoices with the bank for impeccable bookkeeping practices.

Reporting & Analytics

The dashboard is usually the first screen of any SaaS application, offering users a quick overview of the current status, urgent matters, and any major deviations.

The reporting module needs to be highly visual so that graphs and charts are self-explicable and patterns, and dips and valleys can be easily interpreted by all team members.

Due to confidentiality of some information, like payroll, not all users will have the same access levels to all features.

Accounting Tools for the Food Industry: Ready-Made, Customized, or Built From Scratch

Hardly any systems nowadays exist in isolation. Depending on your choice of tools for different functions at your restaurant, you will need to integrate most of the systems so they are synced for a 360 degree real-time overview of your business.

A custom accounting software solution for restaurants takes time and money to develop, but it’s customizable, independent from vendor’s updates, and can be designed to integrate seamlessly with the rest of your infrastructure.

Another perk of building a bookkeeping tool from scratch is that you get to design its architecture in a cloud-native manner, taking advantage of all its advantages [pun intended].

Are you looking for a software development vendor with an extensive portfolio of cases in Restaurant Tech? DevPro has many use cases under its belt, including Payroll and Billing solutions as well as POS tools. Find out how we can help drive your bottom line by keeping your costs at bay — speak to our veteran sales team today.