FinTech is a critical part of digital transformation and it’s currently digesting a lot of innovative solutions, including blockchain. The 6 FinTech blockchain use cases that we scrutinize in this piece illustrate the weight of this recent innovation.

According to the Worldwide Blockchain Spending Guide report by IDC, the blockchain industry was worth $6.6 million in 2021. It will grow at a CAGR of 48% over five years, reaching $19 million by 2024. A sizable part of 2021 spending was consumed by FinTech use cases. The breakdown is as follows:

- Cross-Border Payments & Settlements – 15.9%

- Trade finance – 10%

- Asset Management – 8%

- Identity Management – 7.6%

The numbers are indicative of the towering potential of blockchain technology, which is driving tectonic changes across many industries, including FinTech.

A quarter of companies surveyed by Deloitte in 2020 intended to spend $5-10 million on blockchain in 2021.

How did one technology make it happen? Let’s find out.

Benefits of Using Blockchain in FinTech

The blockchain opens new horizons for businesses, helping solve an extensive range of problems, starting with security and transparency, up to reducing costs and improving the speed of transactions.

Enhanced Security

Diving to the root of blockchain’s design, it’s clear that the system is difficult to hack. The main idea of the blockchain is that no single person can control the system or make changes to it. Each block should be signed with a hash — a unique algorithm with a one-way cryptographic function. An attempt to change any piece of data in the system will most likely fail, as the hacker will need to change every block on a chain, which is nearly impossible.

FinTech businesses can use this inherent immutability to strengthen their security and ensure transparency.

Better Risk Handling

Every stakeholder is treated as a node in the blockchain, creating opportunities for companies in the financial industry. When businesses offer loans, they take on the substantial risk associated with relying on intermediaries. This is where a decentralized system comes into play: every transaction is recorded and there is no way to falsify recorded data due to its immutability — this is one of the key features of blockchain technology. Additionally, peer-to-peer [P2P] transactions eliminate the need for intermediaries.

Quicker Transactions

In a centralized system, intermediaries serve as proof of the system’s reliability. But their involvement can cause delays in the payment processing. Time is money: the longer it takes for payments to settle, the more money companies must spend on this settlement. With blockchain, transactions can be processed with the help of smart contracts and P2P transactions.

Smart contracts allow you to legally and automatically execute transactions without involving a third-party, which significantly reduces the settlement time. The agreement between the buyer and the seller is turned into a traceable and transparent code that cannot be tampered with.

Cost Optimization

By eliminating reliance on third parties, the processing time decreases. Similarly, the costs associated with transactions and intermediaries go down. In the banking and payment realms, the blockchain is capable of driving down costs across many industry functions.

Revolutionary FinTech Blockchain Use Cases

Use Case 1. Driving Efficiency in Data Management

Relying on cumbersome data center infrastructure and sophisticated transaction progressions keeps companies from achieving a digital transformation. The manual reconciliation of transactions is labor-intensive and time-consuming. Both resources can be used for forward-looking and revenue-making initiatives.

Using a functional blockchain network allows companies to step back from managing intricate API integrations because the network automatically facilitates the transaction transfer process.

Below is an example of a blockchain-savvy company that enjoys the advantages of improved transaction efficiency.

SGX [Singapore Exchange Limited]

SGX is an international, multi-asset exchange that offers securities and derivatives trading services worldwide.

This FinTech blockchain use case demonstrates how cloud technology can reinforce the blockchain might, yielding a synergistic effect. The company started by moving legacy infrastructure to the cloud, ultimately opting for a modernized architecture that supports open APIs. Then, SGX chose to use Amazon Managed Blockchain service, which helped to set the blockchain network in a matter of days.

As API integrations no longer needed to be managed manually across various banks, the company’s transaction processing workflow and productivity received a significant boost. As a result of decreased involvement of intermediaries, the average trade settlement period decreased by 60%.

Use Case 2. Digital Identity

Security is one of the key priorities for any financial institution. All transactions must be secure and validated, which is why companies have their own algorithms for identity confirmation. This process can be inconvenient for users in most cases, as it requires them to go through various security checks.

Blockchain can make this step hassle-free with the help of a digital persona. Identities anchored on the blockchain are much more secure, thanks to cryptography. In cryptography, both private and public keys serve two primary purposes: authentication and encryption.

Gemalto

Banks go through the know-your-customer (KYC) process, which is often a pain point for both banks and customers. While KYC requires significant costs and time, it does not always offer additional security, putting data at risk.

Gemalto was one of the first companies to develop a solution called the Trust ID Network — a solution that adopted the concept of “self-sovereign” identity that grants control of identification and access to personal information to the end-user.

While a centralized system simplifies the user experience, the third party is still managing and storing all the information, which leaves room for breaches or fraud. The blockchain is a trustworthy technology itself, enabling independence and decentralization.

Gemalto chose a platform powered by the blockchain, which allows businesses to transact without the involvement of a central third party.

Now a decentralized digital identity application lets banks and other financial service providers access the verified identities of their users.

Use Case 3. Worldwide Payments

A shift to the decentralized system solves numerous issues at once, ensuring security, reduced expenses, and transparency.

Both banks and users seek to find a solution in which money transfers across the world will not involve a long and costly procedure. Payment solutions with blockchain technology include the following benefits:

- Third-party authorization is not required

- As currencies are decentralized, there is no need to involve banks in the transaction

- The payment processing fees are reduced due to the low involvement of third parties

- Security is ensured due to the nature of blockchain technology

Circle

Circle serves as a payment solution for businesses and individuals in over 29 countries. It is a unified platform that lets users accept and send payouts to various parties and countries in numerous currencies.

The company built a bridge between classical bank systems and the blockchain, which allows them to offer unparalleled transactional speed and global interconnectivity to their customers.

At first, Circle only offered users the ability to hold, deposit, or send bitcoin. Now the platform includes the transfer of various currencies and partners with a host of banks. While the solution is powered by the blockchain, payments remain fast and secure, and users can perform financial operations with no hassle.

Use Case 4. Peer-to-Peer Transfers

Even though peer-to-peer transfers exist a range of businesses in FinTech, they have certain limitations. In some cases, parties cannot transfer money to some geographic locations or cannot make the transfer if they are located in a certain region. Large commissions for those transfers also raise an issue.

Using decentralized applications solves these problems. The blockchain has no limitations in regards to geographical location — it exists everywhere and performs transactions in real time, decreasing the time it takes to complete the money transfer.

Data encryption is at the core of P2P transactions, making them a reliable solution for financial institutions that require advanced security measures.

Nuri

Nuri is great example of the company that takes the most out of the P2P transactions. It is an application for saving, managing, and investing funds.

Users can invest in cryptocurrencies by depositing directly from their bank accounts, as well as create a savings plan, which significantly facilitates investment efforts. With a slogan of “banking without the bankers,” Nuri lets customers deposit funds and invest in crypto currencies with just a few clicks, taking advantage of peer-to-peer transactions and reduced commissions.

Use Case 5. Trading Platforms

The trading industry faces many concerns and obstacles that blockchain technology can either fully eradicate or at least minimize. These issues include risk handling, transaction fees management, and administrative spending. Blockchain technology lets companies exchange assets without centralized bodies serving as intermediaries, cutting out one set of fees charged along the complex chain.

Another critical advantage that blockchain-powered trading platforms enjoy is the traceability and immutability of the resulting system. Transaction authenticity can be verified and is next-to-impossible to forge or backdate. In highly-regulated industries like FinTech, and in customer protection-aware countries like the US, this feature of blockchain technology is in great demand.

Coinsquare XCM

As a currency trading platform, Coinsquare provides multi-currency support and builds an enhanced trading experience between different currencies.

The platform is powered by blockchain technology, which allows the company to offer services enhanced security and instant trading capabilities. One of the biggest challenges is maintaining privacy. The tokenization process applied in the project safeguards sensitive trading data, as parties can access private information only with a valid security key.

FinTech Blockchain Use Case 6. Audits

Unlike in other industries, auditing in FinTech is of primary importance. At the same time, it is a pain point for many financial institutions, as it is often a slow, manual process.

Audits involve checking compliance with regulatory requirements to ensure data integrity. Companies keep discovering ways to automate processes and move from the manual tasks.

The blockchain facilitates the process of auditing in the following ways:

- Records can be added directly to the ledger, which helps companies store data more efficiently

- Real-time transfers enable transparency on the ledger, ensuring that all information there is accurate

- Company can charge clients automatically with the help of smart contracts and automated invoicing

- Taking data from various sources is no longer necessary, as specialists can use a general ledger

Deloitte

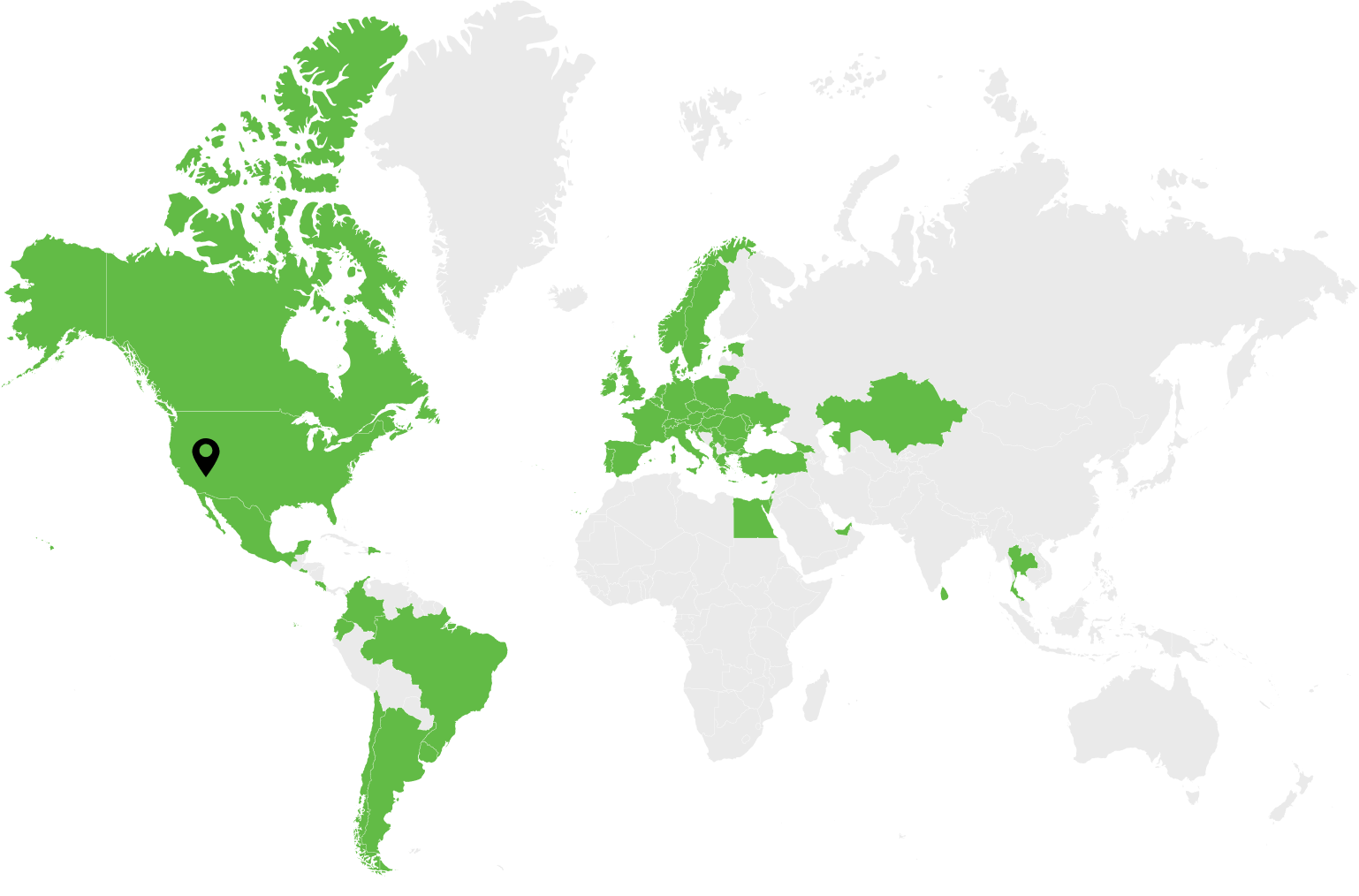

Deloitte expanded into blockchain and continues to experiment with transferring financial audits to the blockchain. Deloitte is a global leader in audit and assurance services that operates in over 150 countries.

Jon Raphael, chief audit innovation officer at Deloitte & Touche LLP, said that blockchain has the power to be transformative in the near future, which will allow it to automate most of the auditing services.

Use of Blockchain in Finance: Future Outlook

Even though many companies have adopted blockchain technology and already see results, the industry continues to gain momentum.

Corporations will be willing to spend $20 billion per year on blockchain by the end of 2024.

Considering the stratistics, more and more companies will enter the market, improving its services and driving innovation in the FinTech domain.

Dev.Pro will gladly help teams that chase these transformations. We have deep knowledge of how to kick off blockchain projects, including helping world famous companies like Inveniam, Securrency, and Coinsquare.

Our sales team will help you define your approach and answer any questions in a 15 minute call. Sounds good? Schedule it here.