SuperApp is not even a buzzword yet. Well, not if you live outside of China. On the innovation adoption curve, this technical phenomenon is still in its infancy, but early adopters are warming up to the idea.

In China, the technology’s mass adoption may have a bit of a Black-Mirror feel to it, as the country’s main super app, WeChat, is pretty much indispensable for the average Chinese citizen, with users comparing it to electricity and water. The application enjoyed massive growth, taking its revenue from $3.6 billion in 2015 to $17.49 billion in 2021 reaching the 1.27 billion users’ mark.

Thanks to robust anti-monopoly and privacy protection laws, the United States and other Western countries have every chance of turning this upcoming technology trend into a bona-fide commodity that simplifies users’ everyday life.

SuperApps for QSR chains is still more about the future, than the present. Both Gartner and CBInsights place the onset of SuperApps in their top tech trends for 2023, but it’s still a novelty and just starting to gain the attention of Senior Innovation Officers and Digital Transformation Directors across major industries.

As a restaurant software development company, Dev.Pro helps drive innovation to the leading QSR chains and their technology vendors. Further, we lay out some of the ideas on how leading restaurant chains could strengthen their positions by jumping on the bandwagon of SuperApps adoption sooner rather than later.

But first, let’s get some fundamentals out of the way.

What are SuperApps?

SuperApps is an evolving collection of composable mini apps built around one core application. The technology is characterized by composability, as independently run mini apps can be uploaded and removed from the major system as needed. A Super App is usually developed based on sizeable user adoption for the core digital service, for example, a messaging or a payment solution.

What do Super Apps do?

Super apps allow users to access the mini apps’ multiple functionalities embedded under one roof by downloading just one core app—with single sign-on [SSO] and payment details stored on a core app for convenience. For example, WeChat in China enables users to exchange messages, make payments, run advertising, order food, hail a taxi, learn the recent news, look for real estate, and book tickets for traveling and concerts.

Super Apps: Architecture & Technical Set Up

These added complexities make super app development quite a nuanced cumbersome process:

- Multiple services on one app, sometimes offering dozens of various functionalities.

- Multiple developer teams working simultaneously—some of the services are developed by the core app team, but partnerships are a huge part of the existing super apps, where third-party services are available in marketplaces to use with one tap.

- Scalability is critical, as the number of users, services and third-party players grows over time.

- Sign-on and payment features are shared across the entire application.

- One-tap enablement of the mini-app and easy removal.

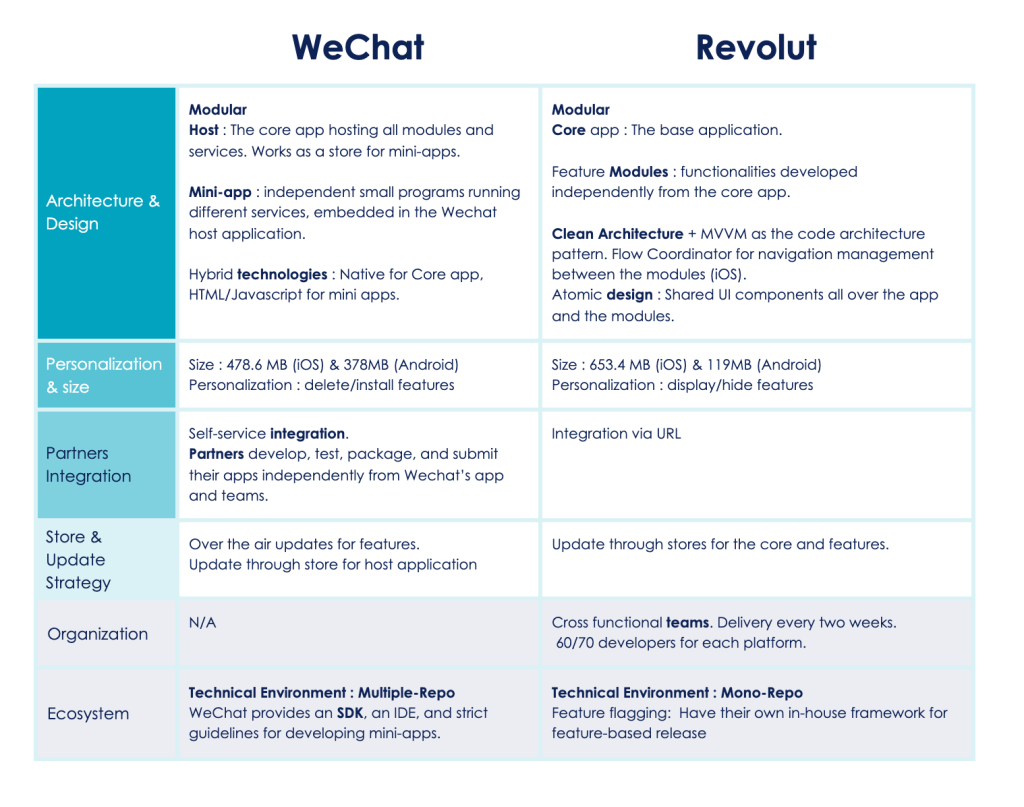

Let’s see some of the technical decisions taken by the biggest super apps in 2023. Octo compares Chinese WeChat and British-Lithuanian’s Revolut in this comprehensive table, looking into architectural, integration, ecosystem, organizational, and update approaches.

Hana Amiri of Ionic explains the major technical architectural decision to be made to enable scalable super app development. Namely, and similar to microservices and micro frontends, micro apps, or mini apps, are the way to design multiple disparate services with loose decoupling.

Amiri breaks down the development options into Native [iOS Frameworks, Android Archive Libraries or Android dynamic features] and Hybrid solutions, or micro-frontends [which can be either custom micro-frontends or Ionic portals]. Watch the video for a detailed breakdown of their respective advantages and disadvantages.

What Are the Characteristic Features of a SuperApp?

At this early stage, the list of Super App features—technical, commercial, and usability-focused—is still work-in-progress. Let’s consider some of those that have already taken shape.

Composability & Personalization

Users can keep their SuperApp in its initial single-app form by never activating the mini apps in the ecosystem. Or they may pick and choose the ones needed at the moment, or daily.

Permanent Evolution [WIP]

As mini apps get developed or even uploaded by independent developers to an internal store, the ecosystem constantly evolves. New release update notifications can be used to educate users about upcoming changes.

Sizeable MAU

It takes a super app to evolve into a SuperApp. Only a company with a substantial user base can have a feasible commercial reason to invest in superapp development. MAU of anything below 1 million is hardly a great foundation.

Loosely Coupled Architecture

Any type of loosely coupled architecture is the way to go in this case, as a user can activate and remove the mini apps as needed.

Simple User Authentication Across the App

SSO is most frequently used in super apps since this environment should provide a seamlessly integrated experience across multiple connected systems. In fact, being able to download one app and enjoy an endless number of its mini apps functionalities is what makes this technology so vital for a user. Enabling all these secondary software solutions in the ecosystem usually takes as much time as tapping a consent button.

Mobile-First Design

When it comes to applications, most come as mobile-first design projects in 2023, but for super apps, this is even more critical because they are supposed to be used multiple times throughout the day.

Intuitive UX & Navigation

While the Super App concept is new for many, the core design features remain the same. This is why keeping as many of the traditional navigation elements as possible is so critical for a great user experience. The icons, arrows, color coordination, tags, search, filtering, and sorting are all major to UX.

Innovator & Leadership Status

The technical features boil down to this technology trend’s final market characteristic: the development of Super Apps is the prerogative of the bigger players. Ultimately, in a few years, it’s going to be another facet to compete over for market leaders in any niche. It’s going to be the differentiating factor of Innovators and trend setters.

Super Apps for QSR Chains

While the payment and messaging applications are the first organic candidates to evolve into Super Applications, we believe that every industry will find its way to offer more in its core digital interface.

Dev.Pro’s key field of expertise is in Restaurant Tech and POS software development, so it’s only natural that we are looking into possible applications and execution paths in this industry.

Characteristics of SuperApps that May Emerge in the QSR Segment

It’s not too far-fetched to imagine that super app development will evolve into more niche industries sooner rather than later. While currently they stem mostly from financial and messaging core applications, their spread to any major businesses with MAU numbers of over 1 million could be a reality.

Under the above conditions, these are some of the possible classifications:

- Client-facing

This is the obvious default-facing mode.

- Team-facing

Team members may get access to internal company applications related to scheduling, appraisal, and financials. For example, bigger corporations with hundreds of thousands of employees may have their white label, neobanking solutions available for team use. All sorts of partnerships and special discount programs become possible between corporations, for example, a taxi service company and a QSR could strike a deal for mutual discounts for employees and clients, providing each other’s application for downloading as a mini app in a partner’s super app.

- Vendor-facing

The purchasing departments of big foodservice operators and retail stores have to sustain so many business relations and activities that vendor-facing mini apps are another possibility for business growth. For example, vendors may get access to all the negotiation, logistics, and inventory management tools inside once they have identified themselves as vendors.

- Industry-focused

As industry cloud services are becoming a new norm, specifically in industries with sensitive data such as Health Tech and FinTech, industry-facing super-app editions may also become a thing. These may be designed by the bigger players, with the shift-and-lift type of expertise and software tools to share with smaller players for a monthly subscription or a cut of the revenues. Potential mini apps in this category may be a marketplace for low-code industry software solutions, purchasing tools with vendor databases, and so on.

What Mini-Apps Could be Developed to Turn a QSR App into a Super One?

Now that we are hypothesizing, if any of the QSR chain giants would ever consider starting to develop a super-app, what mini apps could be part of their ecosystem?

Loyalty App

Loyalty and promotions are a huge part of the QSR applications now with any home screen having multiple tabs on discounts, points, and offers. Should a core application go into a super-app mode, these functionalities are likely to be split into mini apps, with a lot of gamification and personalization features.

Parcel Drop Off & Pick Up

As many fast-food chains have a wide network of physical stores with significant underutilized space, self-service parcel lockers embedded in the design is a possibility. Not only will this increase the foot traffic to the outlet, as people come to pick up and post their stuff, but also provide a revenue stream with huge potential, as eCom is growing. Partnering with big delivery companies may also bring in some exclusivity fees.

Classifieds & Advertising

Another revenue stream for super apps with substantial daily visits is advertising. While ads are more the prerogative for companies that do messaging and social media as their primary offer, if any QSR players manage to build a super app with constant sizeable traffic of daily users, advertising becomes an option.

Networking [Off-Line and On-Line]

In the digitized world, with ever-growing screen time, fast-food outlets are a perfect spot for offline networking. The functionality of such software doesn’t need to be complex, as people are only sharing a 20-minute lunch and are already in the same store. So, all it takes is for both of them to register their willingness to find a buddy for lunch and locate each other.

A mini app for offline networking could turn into a great LTV value booster move, as lonely people may frequent the eatery more often to mix with other communication-hungry visitors. Supporting such a simple idea with the hashtag [#meetafren sounds good?] would increase awareness about this mini app and may make this offline communication more attractive to younger audiences.

The online in-app messaging feature could also be a thing, provided its logic is tied up with other loyalty perks.

Educational Trivia or Challenge of the Day

Another marketing opportunity lies in the realm of entertainment, education, motivation, and self-exploration. There are hundreds of apps with daily quotes, fun trivia questions, affirmations, or historical facts. Creating apps for different age groups is easy and boosts loyalty. When combined with gamification—people getting to compete to solve a riddle or answer a question of the day—can have quite high retention since people are competitive by nature.

Recipes App

This feels natural for restaurants to share recipes, right? Home cooking mini apps could be specific, like a dessert recipe app for Starbucks or a sandwich recipe library for Subway, but they can be general as well.

Calorie-Calculators

FDA regulation made it a norm to state the calorie value of a meal on the menu, so all quick-service restaurant chains are in the habit of dealing with calories anyway. This app could be as simple as a manual calorie calculator, or as complex as having AI recognize the items on the tray, total the calories, and sync the information to the general daily count.

Potential Partnership Opportunities for Superapps for QSR Chains

Mini apps can be embedded in the core app in a number of ways technically, depending on the developer—if they are proprietary or partner apps. The allocentric business model suggests partnering, with a diverse number of services to create extra value for the user, even if this means partnering with the competitors.

These are some of the possible partnerships that QSR could leverage based on their user databases.

Tourist Info, Review & Recommendation Engines

Depending on the current geo-location, users could get access to the limited version of the review and recommendation apps to both: review the local tourist attractions, find them, and book tickets.

Grocery Shopping

The grocery ordering and delivery module could be both proprietary and third party. A proprietary mini app could have simple functionality with pre-set shopping lists from state-wide stores on a recurring basis. Partnership-driven apps would work best with suppliers that operate nationwide, with shops and warehouses represented in all major locations of the QSR.

Discount Engine

Everyone loves a discount. Bigger chains can leverage their brand to secure discounts for their loyalty members across a wide range of services—from credit cards to cinema chains.

Petrol Stations

Quick-service restaurants are common neighbors to gas stations on the highway. This opens many opportunities for cross-marketing, specifically in areas with multiple fast-food restaurants and or multiple gas stations in one location.

Banking

While it may seem somewhat far-fetched that QSR chains would have more extensive banking functionality than needed to pay for the food, however, partnership with banks may be a viable scenario.

Some chains have hundreds of thousands of employees they pay salaries to. This is a sufficient user base to provide a neobanking solution with lower commission rates. Such a move can be used as leverage to grow employee loyalty in the market when team retention is a perpetual struggle.

How USA Super Apps May Be Different from Asian Ones?

Due to privacy policy concerns, anti-monopolistic economic setup, and legislation, as well as the dominance of Apple devices [that reduce the friction of sign-on and payment due to Apple ID], experts are skeptical about super apps’ future the United States. To be more exact, western and eastern versions are likely to be vastly different.

Hear how Leo Laporte from the popular “This Week in Tech” podcast discusses the super app phenomenon with Amy Webb from Future today institute, Connie Guglielmo from CNET and Dwight Silverman from Authory.

At this early stage of this trend, American super apps may fail to grow to a national level quite as big as Chinese ones, but industry leaders could try and grow their own apps, including some of the partner mini apps, too.

From our hypothetical assumptions based on the fast-food industry, we showed how these features could evolve to define the industry-leading composable applications:

- Catering to multiple users [with account-based access to specific apps]

- Clients

- Team

- Vendors

- Industry

- Expanding their functions beyond food by tapping other opportunities:

- Entertainment

- Productivity

- Marketing

- Loyalty

- Media

- Using super apps to conclude exclusive partnerships as part of a loyalty program [from neobanking to ticket-booking]

So, they could be a collection of applications under one umbrella—third party and proprietary—which could be dynamically loaded with SSO and share the payment details. But they would be more about providing a fully rounded versatile experience to a user, employee, or vendor, rather than a one-stop shop for the entire nation for an endless myriad of functions.

Last but not least, another way the super app concept could manifest itself in the QSR industry is through partnerships.

If Amazon, Twitter, or Meta, manage to grow into some form of a super application in the United States, they could be extending their marketplaces to QSR chains to load their limited versions of apps as partners.