Did you know that 73% of customer interactions with banks now occur through digital channels? Fintech organizations occupy a unique niche within the modern financial services landscape.

While fintechs are known for pushing the boundaries of personalization and convenience, they are also vulnerable to the unintended consequences of rapid innovation, as well as external pressures like cybercriminals and rising customer expectations. To remain competitive, fintechs must do more than modernize individual features like digital wallets. They must transform entire software ecosystems with novel technologies like AI, cloud architecture, and blockchain.

In this article, Dev.Pro explores the different factors pushing fintech to grow and change, as well as our role in bringing these evolutions to life.

The Forces Reshaping Financial Technology

The fintech landscape is shifting as rapid technological innovation intersects with rising regulatory demands, evolving market trends, and increasingly sophisticated cyber threats.

Rising Customer Expectations for Speed & Personalization

Whether paying through modern POS systems, receiving tailored insurance quotes, or executing trades in real time, consumers now expect instant, intuitive financial interactions with fintechs. New AI technology is rising to the challenge. As Netguru explains, “the average time spent on AI-personalized sections of fintech apps increased by 34% [in recent years] compared to non-personalized sections. These numbers aren’t just statistics – they represent real shifts in how customers engage with financial services.”

Intensifying Regulatory Burdens

Once positioned outside traditional banking frameworks, many fintechs now deliver bank-like products that raise expectations around consumer protection, governance, and risk management. Regulators like the OCC, FDIC, and Financial Stability Board are responding by targeting security and compliance gaps with fintechs. Enforcement actions reached $96M in trading violations and $77.5M for consumer data misuse in recent years – reflecting real-world examples of heightened expectations concerning governance, transparency, and risk controls.

Cybersecurity Threats at an All-Time High

Since they are predicated on ease-of-use, real-time transactions, and sensitive data, fintechs are prime targets for cybercriminals. Today’s notable threats include:

- Identity fraud

- Data breaches & PII exposure

- Insider misuse

- API exploits

- AI & cloud vulnerabilities

Between 2021 and 2023 alone, identity fraud cases in fintech increased by an astounding 73%. Beyond obvious financial losses, successful cyberattacks lead to regulatory penalties, operational disruptions, and loss of consumer trust.

Core Technologies Powering the Future of Fintech

Whether discussed in terms of Web3 or the emerging agentic web, new technologies are reshaping how fintechs build, deploy, and scale modern financial products.

AI & Machine Learning

AI is transforming fintechs by automating complex decision-making in fraud detection, credit scoring, underwriting, compliance, and more. By training AI models on large, continuously updated datasets, fintechs can identify patterns, reduce false positives, and improve accuracy over time. Wealthsimple provides a clear example of the impact AI can have on operational efficiency. The digital wealth management organization saves more than $1 million annually by using AI-driven knowledge management to eliminate time-consuming manual workflows.

Cloud Native Architecture

The cloud-native applications market is expected to expand from $10.44 billion in 2025 to $46.05 billion by 2032, reflecting a more than fivefold increase over 8 years. Within this realm, cloud-native architecture is reshaping fintech by decoupling monolithic systems into microservices deployed via containers and orchestrated with Kubernetes. This approach enables horizontal autoscaling, fault isolation, and continuous delivery. For example, cloud deployment allows payments platforms to scale authorization, fraud detection, and settlement services during user peak spikes while maintaining low latency and high availability.

Blockchain & Digital Assets

Blockchain and digital assets are revolutionizing the fintech space with decentralized frameworks that eliminate intermediaries, automate complex financial agreements, and fractionalize high-value assets. These technologies have transformed transaction speeds from days to seconds and proven particularly impactful with cross-border payments. Blockchain also reduces operational costs and enhances security through cryptographic ledgers. Driven by smartphone usage and end-to-end digitization, the fintech blockchain market is poised for significant expansion, growing from $0.48 trillion in 2024 to nearly $21.59 trillion by 2034, or roughly 44 times its size in 10 years!

High-Impact FinTech Application Areas

As fintech innovation accelerates, several application areas are emerging as critical drivers of growth and differentiation.

Custom POS Platforms for Financial & Hospitality Innovation

Software environments in restaurant, travel, and hospitality are often highly complex and shaped by legacy systems, on-premises infrastructure, and numerous existing integrations. To counter these challenges, modern POS platforms have evolved into intelligent financial hubs that unify systems and streamline services like payments, inventory, and loyalty. For example, an airport food service operator may run a POS platform that connects on-prem kitchen systems with cloud-based payments, inventory forecasting, and fraud monitoring across dozens of locations.

Alternative Trading Systems

Alternative trading systems (ATS) like INX, Forge Global, and Tradeweb are rapidly expanding access to private markets, tokenized assets, and fractional ownership models. In turn, they are giving individuals access to stock market trading opportunities that were historically restricted to a small group of participants. To illustrate, investors can now trade shares of private companies or tokenized real-world assets outside of traditional public exchanges. This shift is reshaping capital formation by improving liquidity, price discovery, and market transparency beyond traditional models.

Crypto & Web3 Financial Products

Crypto and Web3 solutions are redefining the financial infrastructure through blockchain payments, digital wallets, tokenization, and smart contracts. Web3 refers to a more user-centric evolution of the internet that incorporates decentralization, blockchain technology, and AI into everyday digital experiences. This decentralized evolution of the web has near-endless potential with PII governance, service personalization, and enhanced convenience across verticals like hospitality, retail, entertainment, and healthcare.

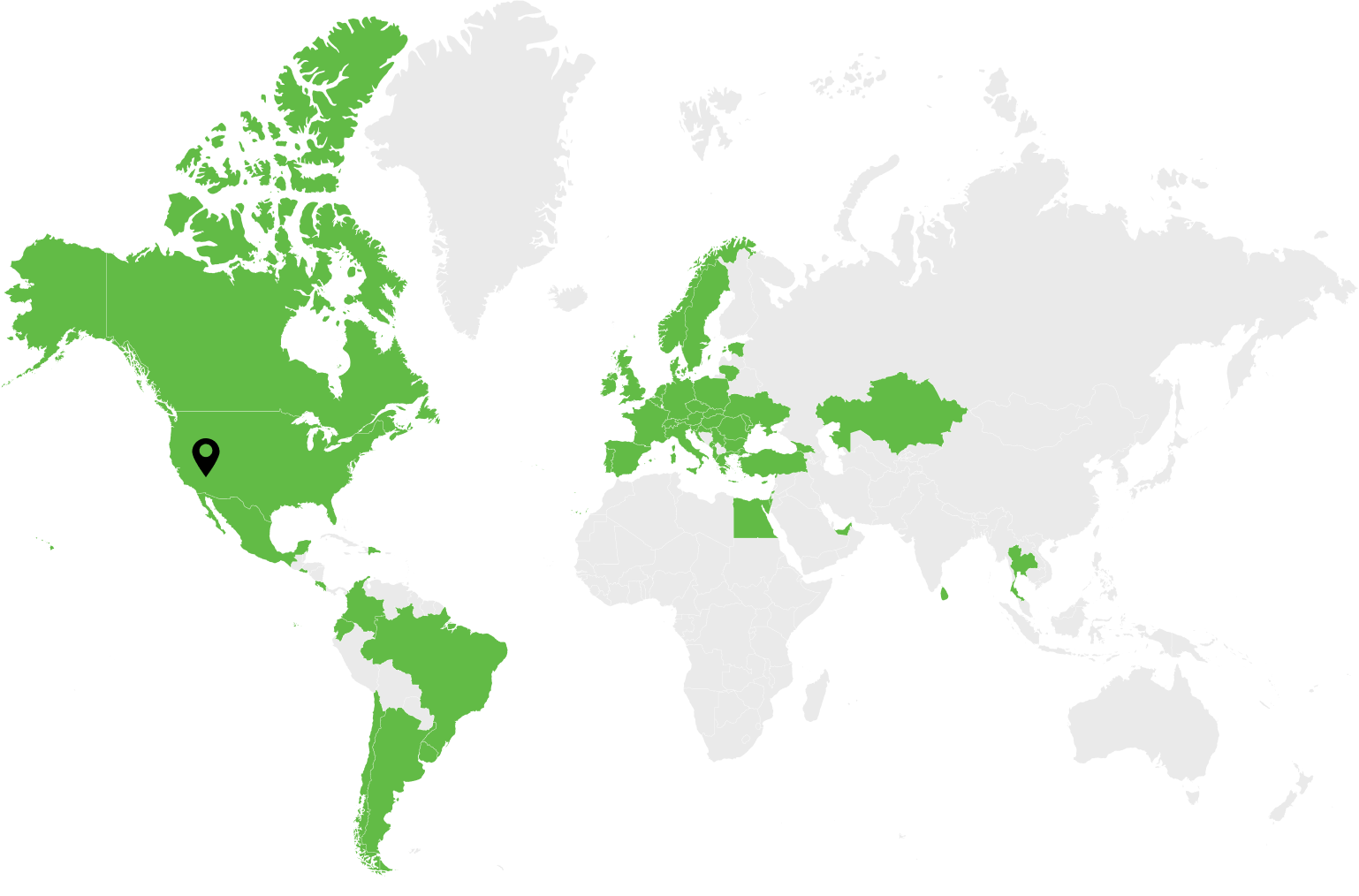

Dev.Pro: Solving the Biggest Engineering Challenges in Fintech

Despite latent opportunities, many fintechs struggle to keep pace with emerging technologies and shifting market pressures. In many cases, internal teams lack the specialized expertise required to execute complex digital transformation initiatives. With a highly skilled team of fintech domain experts on hand, Dev.Pro closes these gaps through a strategic, engineering-focused approach:

- Interoperability Across Legacy Payment Rails & New Digital Systems: Dev.Pro is well-versed at integrating legacy payment rails like ACH and SWIFT with modern APIs and cloud platforms. In turn, new digital products can run reliably alongside mission-critical systems without compromising performance.

- Scaling Without Compromising Security: Our team of specialists builds secure, cloud-native architectures using Zero Trust, encryption, and DevSecOps. With Dev.Pro’s expertise, fintech clients can scale safely while meeting PCI DSS, ISO/IEC 27001, and regulatory requirements.

- Reducing Operational Costs Through Automation: Whenever possible, Dev.Pro applies automation and AI to streamline onboarding, KYC/AML, reconciliation, and reporting for fintechs. When executed properly, these systems reduce manual effort, lower costs, and improve accuracy across financial operations.

- Closing the FinTech Talent Gap: Backed by over 9 years of domain expertise, Dev.Pro supplements internal teams with expert engineers. Clients scale talent up and down as needed with modernization projects, while taking advantage of both outstaffing and outsourcing hiring models.

Build the Next Generation of FinTech with Dev.Pro!

As fintech systems grow more complex, success depends on secure architecture, seamless integration, and happy users. Dev.Pro partners with fintech organizations to accelerate innovation across payments, trading, insurance, digital assets, and more.

Schedule a call to get started!