Researchers expect that 80% of credit risk companies will have adopted some form of AI by the end of 2025. Especially in a heavily regulated industry like fintech, there must be good reasons why so many organizations are making this rapid shift.

At its core, credit risk analysis evaluates trustworthiness and repayment probability. To make these decisions, systems rely heavily on static models, historical trends, and manual decision-making. Yet, these risk assessment methods are at direct odds with a modern economic climate that is defined by speed, complexity, and constant change.

AI offers a more dynamic and streamlined approach to assessing creditworthiness, thereby giving fintechs a competitive edge on several critical fronts.

Issues with Traditional Credit Risk Assessment Strategies

Despite being the foundation of lending decisions for decades, traditional credit risk assessment methods are increasingly falling short in today’s fast-moving financial landscape.

Manual Underwriting

Since traditional underwriting relies on manual data collection, input, and analysis, it creates countless inefficiencies. Not only do analysts spend hours gathering financial statements and tax records, but they also calculate ratios by hand or with basic spreadsheets. This reliance on manual underwriting increases labor costs, slows lending decisions, limits growth, and creates risks of human errors.

Reliance on Historical Data

Traditional credit risk analysis depends heavily on historical financial statements and past performance. Yet, financial statements from the past can be lagging indicators that fail to capture rapid market shifts and prevent blind spots. Slow data refresh and the inability to integrate real-time events leave lenders with an incomplete and sometimes misleading view of credit risk in the present moment.

External Market Pressures

Fintechs face rising demand for instant credit decisions, especially with popular new Buy Now, Pay Later (BNPL) and peer-to-peer lending movements. As a case in point, leading BNPL provider Klarna processes millions of real-time approvals daily. At the same time that customers demand quicker, seamless service, regulators are pushing for increased control and regulation on digital lending practices.

Key Benefits of AI-Powered Credit Risk Assessments for Fintechs

By integrating AI into credit risk assessments, fintechs unlock faster and smarter lending practices that drive growth. Key benefits include:

- Improved Accuracy

- Reduced Defaults

- Scalable Decision-Making

- Operational Efficiency

- Stronger Online Security

How AI Improves Credit Risk Assessment

AI is redefining credit risk assessment by moving beyond static credit scores and manual processes to deliver faster and more accurate evaluations.

Fraud Detection

AI strengthens fraud prevention by using behavioral analytics and pattern recognition to spot anomalies. With global digital payment fraud losses projected to exceed $48 billion by 2026, the stakes are high. AI helps flag suspicious accounts, uncover discrepancies in loan applications, and minimize costly mistakes for lenders and customers alike.

Broader Data Sets

Unlike traditional credit scoring methods that rely mainly on credit bureau reports, AI-driven models tap into a much wider range of information. They can evaluate transaction histories, utility and rent payments, mobile usage patterns, and even education or employment records. The use of non-traditional data can significantly improve default prediction, particularly for underserved borrowers.

Real-Time Risk Modeling

AI enables lenders to move beyond static credit snapshots and adopt continuous risk assessment. By analyzing live transaction data, market signals, and borrower behavior, models can detect changes in creditworthiness in real-time. This empowers lenders to respond faster, reduce defaults, and make more confident lending decisions.

Machine Learning

Machine learning (ML) uncovers patterns that traditional risk assessment models often miss. By training on vast data sets, algorithms identify subtle indicators of default probability with greater precision. ML delivers more accurate risk scoring at scale, enabling lenders to minimize losses while confidently extending credit across growing loan portfolios.

Conclusion

The global digital lending market is expected to reach $20.5 billion by the year 2026. While such growth is exciting, it’s important to remember that traditional credit risk assessment methods can’t keep pace with today’s rapidly changing economic climates. As they lag behind digital transformation, lenders may be left more vulnerable to unforeseen defaults and missed opportunities.

AI is redefining credit risk assessment by drawing on broader data sets, enabling real-time modeling, improving fraud detection, and enhancing overall accuracy. Moving forward, fintechs anticipate that AI may finally strike the perfect balance between convenience, security, and compliance in financial services.

Dev.Pro: Your Fintech AI Partners!

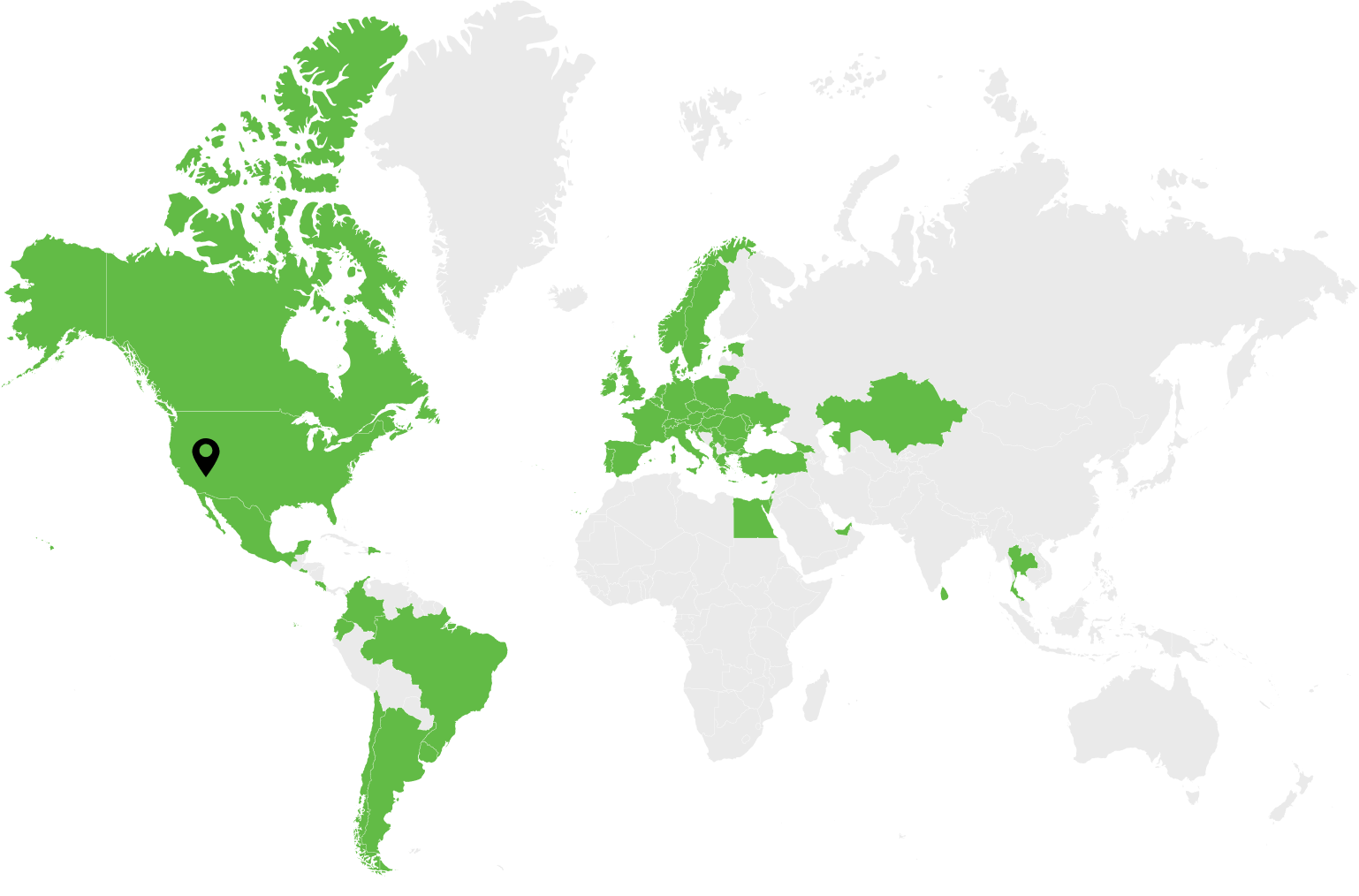

Dev.Pro has helped many leading fintech companies harness the power of AI, while also navigating compliance complexities in highly regulated industries. From building predictive risk models to ensuring strict adherence to security frameworks, our specialists deliver AI solutions for fintech that are both innovative and audit-ready.

As your technical partner, Dev.Pro offers outstaffing and outsourcing solutions to meet any project need!

Let’s discuss how we can accelerate your AI roadmap!