Custom Restaurant Payroll Software offers high levels of flexibility, seamless two-way syncing with existing software ecosystems, individual bonus system management, and unique team incentive formats.

With stakeholders in three major departments — HR, accounting, and operations — this tool needs to be cloud-based and have a robust access management module with role-based permissions and a mobile application. It can also be connected to an IoT device so that team members can clock in and out transparently.

With 12.5 million workforce in 2020 in the US restaurants alone, there’s lots of efficiency to be gained in managing salaries and multiple processes to be automated. To give you a scale of things, the combined population of Denmark and Finland is still less than the number of restaurant employees in the States.

What is Restaurant Payroll Software?

Two things set payroll solutions specifically designed for the Food and Beverage industry from other universal tools: tips management and by-the-hour scheduling.

Restaurant Payroll software is an on-premise or cloud-based software system that is used to plan, file, process, report and analyze restaurant employees’ payroll, tips, attendance as well as perform some tax functions.

These systems can be standalone applications or or a module of a restaurant management solution, out-of-the-box or custom made.

Let’s get down to features, benefits, specifics of integrations of restaurant payroll systems.

Why Do Restaurants Need Payroll Software?

There’s no need for a Mom and Pop diner to buy a subscription to a payroll SaaS for a team of seven.

Bigger operations, however, can gain a lot by using a software as a service payroll tool, while the leading restaurant operators can opt to develop a custom restaurant payroll system. Here’s why:

Employee Satisfaction & Lower Turnover

According to industry estimates, restaurant employee turnover may reach 100-150%, meaning that the same position will be occupied by at least 2 people in the same year. Amid a worsening labor force crisis, people are looking for less stress in their work routines.

According to a survey, one error in payroll makes people start looking for other employment opportunities and two errors make nearly half of employees start job hunting.

Having to fill out rota sheets, take care of taxes, tip management is cumbersome for all parties: from HR and accounting to employees and management. Paper work is hardly a favorite routine for team members, so having an automated system looking after this chore helps boost morale and job satisfaction.

Automation Leads to Increased Efficiency

Rota management and distribution can take dozens of hours when done manually or using a spreadsheet. A software solution reduces the time spent on the task significantly.

Minimizing Human Errors and Respective Fines

Human errors in time tracking and payroll management can lead to unsatisfied colleagues, wasted time and even fines from governmental authorities. Automation significantly reduces the chance of human error.

The IRS assessed nearly $31.4 billion in civil penalties in FY 2020.

Higher Average Check

Not every vendor tool will have a module for calculating bonuses and incentives, let alone support for a gamified team contest.

But when you develop a custom restaurant payroll software, you can include features like custom team contests to drive internal competition between servers for upsells, and higher average checks. Bonuses can be calculated as per verified analytics for each server based on a contest formula.

If the server’s average check is 20% higher than last month, the employee gets X% bonus.

Or, if the average check of a team member is the highest for the area, the employee gets Y% bonus.

Better Schedule Planning Due to Integration with POS

Schedule transparency and flexibility is the second most critical need of shift workers, preceded by increased and accurate pay and followed by recognition and support.

Naturally, a payroll system integrated with major restaurant management platforms allows management to satisfy this priority of their shift workers.

Visibility on an Area Level

Large food operators have more chances to succeed thanks to big data. They can learn a lesson from one location and apply these insights at thousands of outlets, amplifying the ROI.

Similarly, in payroll management there are a lot of analytics that can help improve the performance on various levels due to high level visibility. Restaurant management can have a granular level of understanding of the payment and scheduling and can be incentivized based on related KPIs.

Is There Room for New Payroll Solutions?

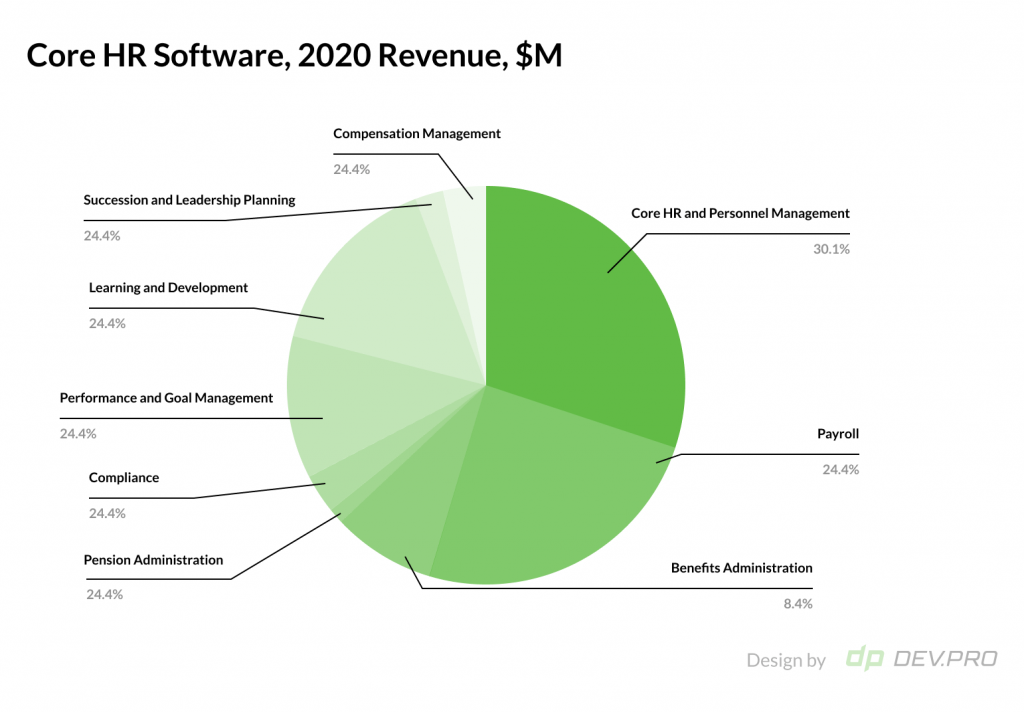

According to Apps Run the World, the Core HR software market reached $19.4 billion in 2020, with payroll management systems accounting for $4.74 billion. That’s a quarter of the entire core HR tech segment.

Interestingly, the leaders in payroll software development have a fair share of distribution, and the top 10 players only occupy 59.3% of the market, while the remaining 40.7% is left for smaller companies.

The top five leading payroll software vendors are:

- ADP

- Paycom

- Workday

- Intuit Inc [QuickBooks software]

- SAP

While there are multiple solutions that use the SaaS model, where companies can purchase a monthly subscription at a reasonable rate and enjoy all the benefits of a leading tool, bigger players may want to develop custom payroll systems.

When building a software solution from scratch, you get the flexibility and independence from the vendor, and can ensure a high level of customization.

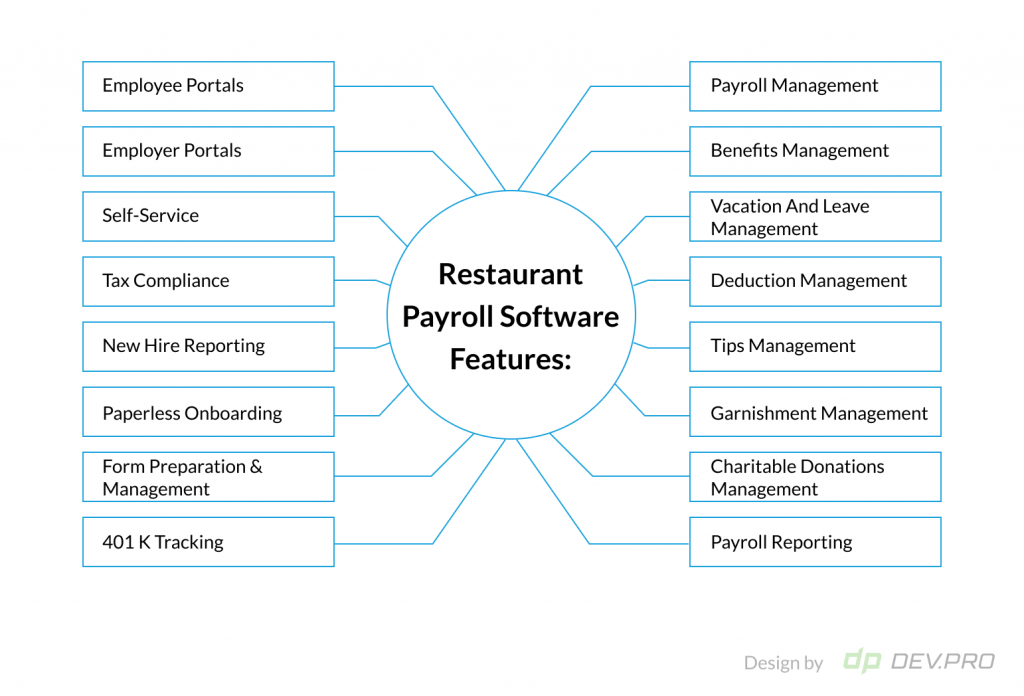

Most Useful Restaurant Payroll Software Features

Payroll software features are location dependent, as they need to deal with the country-specific financial system, legal system, taxation and be compliant with labor regulations.

When it comes to payroll systems for restaurants, tip management, and hourly scheduling are must-haves.

Employee Portals, Employer Portals, and Self-Service

Robust MFA and role-based access are vital features for all software solutions that have users with different levels of access and deal with financial and other PII data.

User-friendly employee and admin portals need to be both secure and intuitive.

Tax Compliance

The best payroll solutions will automate your tax administration, from calculations and filing to automatic payment. In the US, employers are required to administer a number of taxes at the state, local, and federal levels.

New Hire Reporting and Paperless Onboarding

Onboarding a new hire requires multiple actions to register the employee with respective agencies, join them to a pension fund, file forms to the tax office, etc. A robust payroll solution will help automate the process and make it paperless, using e-signatures.

Form Preparation and Management

Annual forms 1099, W-2, 940 as well as quarterly forms 8974, and 941 need to be calculated and filed with tax authorities. Then there are local and state forms that are pre-configured with multi-state tools. E-fax, e-sign, and email technologies help keep this process paperless.

401 K Tracking

US-based companies may need to integrate their payroll tool with 401(k) plan administration. The manual management of an employer-sponsored retirement fund plan is tedious and time consuming.

Payroll Management

The key feature of this software is the calculation and processing of payroll for employees according to their role, rates, hours worked, contracted terms, and deductions.

Benefits Management

Benefits like medical insurance and 401(k) plans can be automated to be processed with payroll.

Vacation and Leave Management

When employees get sick or go on vacation, their contract terms need to be applied. Time-off policies need to be configured by company, role, and department.

Deduction Management

Deductions can be programmed to be processed pre, or post-tax according to regulations.

Tips Management

One of the most important features of payroll software for the restaurant industry is the tip management module. It needs to comply with requirements of the FLSA Tip Credit minimum wage.

Garnishment Management

Child support and other garnishments can be automatically paid on a regular basis from employees’ accounts according to the legal framework of a specific state.

Charitable Donations Management

In line with a socially responsible mindset, the best restaurant payroll solutions will enable direct payment of charitable donations with automatic deductions.

Other capabilities can include the following features:

- Payroll outsourcing

- Payroll reporting

- Hourly and salaried employees

- Multiple pay rates

- Multiple schedule

- Direct deposit

- Multi-country

- Multi-state

Needless to say, automatic tax processing and form filing requires a number of mission critical integrations. Let’s delve into the main payroll integration systems.

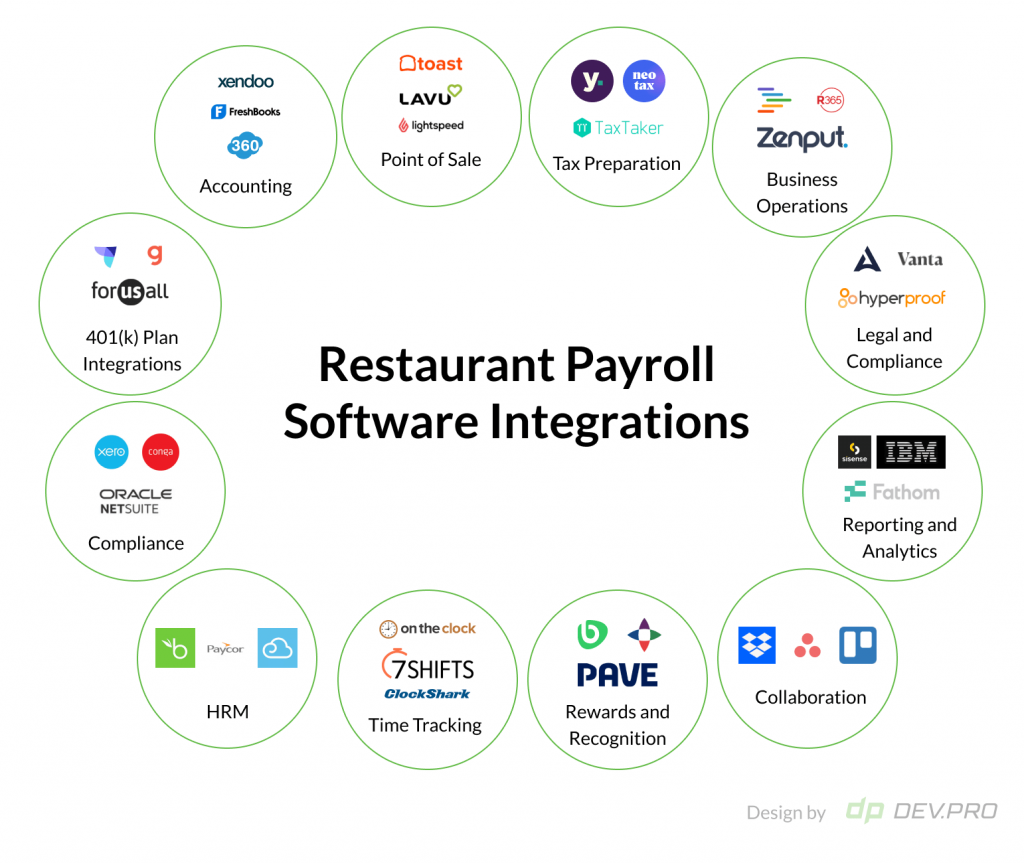

What Integrations Should Your Restaurant Payroll Software Support?

Restaurant payroll tools must be integrated with multiple systems, including but not limited to: HRM, ERP, CRM, accounting management system, Restaurant POS, business operation, legal and tax management tools, time tracking, and collaboration, as well as compliance management solutions. Naturally, the payment side also requires integrations with banking, financial systems, and gateways that are PCI compliant.

- Accounting

- Point of Sale

- Tax preparation

- Business operations

- Legal and compliance

- Reporting and analytics

- Collaboration

- Rewards and recognition

- Time tracking

- HRM

- Compliance

- 401(k) plan integrations

How to Secure a Restaurant Payroll Software System

When developing a custom payroll system from scratch, solution engineers need to keep in mind a number of legal requirements, including the GDPR, PCI, HIPAA, and SOC 2 frameworks.

Security is best conceived at the planning stage of project development, when solution engineers embed secure features at each step of the way, continuing with the best practices of DevSecOps at the Design, Build, Develop and Deploy stages of the SDLC.

Proper data encryption protocols, regular backups, secure data center practices, use of last minute developments in access controls, authentication, and vulnerability management are just a few of the focal points for Dev.Pro’s DevOps engineers to focus on.

Further Insights on Top Restaurant Management Software Solutions

Dev.Pro team has plenty insider knowledge to share in the field of our core expertise: Restaurant management software development. Check out these top pieces on the topic:

- 2022 Guide to Restaurant Accounting Software with 12 Key Features

- IoT Integrations for Restaurants: Inevitable and Urgent [with Videos]

- How to Build an Automated Restaurant Ordering System [with Blueprint]

- Fast Food Automation: Benefits and Impact [with Videos]

- State of Restaurant Tech 2022 White Paper [360-degree industry overview]

Trust the Professionals to Develop Your Restaurant Payroll System

When the time comes to answer the question: How do we create a payroll system, the second question to be answered is: Do we have enough expertise in our internal team to develop a secure, functional, multi-state software that has extensive integration capabilities?

If you feel your team could benefit from external help at any stage — from solution architecture development to building a code and deploying it in line with the best DevSecOps and FinOps practices — reach out to our expert team for a consultation.

Our team of 700+ engineers has completed a number of projects in the restaurant and hospitality businesses, including payroll, analytics, and POS development. Check out our portfolio for a list of relevant cases.